7 Ways to Grow Your Insurance Business

As a small business owner you should always be on the lookout for inexpensive ways to grow your business.

Of course, what might not cost you in dollars, will cost you in time and effort.

But the right effort in the right places can pay off in spades.

Below are 7 ways to help grow your business. They aren't all that complicated, or expensive. They just aren't always used to their fullest effect.

Individually they are all important, but, used together they are a force multiplier that will amplify your chances to grow your business.

Section Links

⍟ Find Your Unique Value

⍟ Improve Your Communication Skills

⍟ Create a Client Communication Strategy

⍟ Leverage all Media Channels

⍟ Continue to Learn

⍟ Create a Referral System

⍟ Take Time to Review and Evaluate

1. Find your unique value

Start with your WHY. Is there a bigger purpose to selling senior insurance products?

Do you want to help seniors find the best solutions to access medical services so they can better enjoy their golden years?

Do you have a personal experience that people can relate to?

Maybe you have a family member that had a hard time accessing health care as they got older, and now you want to help people avoid that situation.

Whatever your bigger picture is, put it into words and make sure it really captures WHY you do what you do.

Let that purpose define your business.

Use it to describe not just what you do but who you are. Avoid a business introduction that just says “I sell this or that product”.

People don’t really care what products you sell.

There are plenty of people selling those same products.

There are a number of competitors who may sell what you sell, but how many of your competitors have the same WHY as you?

This is a unique value that makes you stand out from your competitors.

Lead with your WHY statement and show them you care about helping them.

When they show interest, answer their questions from that perspective, tying in products that might help them.

“ People don’t buy what you do. They buy why you do it. ”

- Simon Sinek

2. Improve your communication skills

It goes without saying that communication is incredibly important.

Communication starts with listening. If you can’t listen carefully and understand why someone is seeking a solution you provide, then your chance of selling to that customer is greatly reduced.

Your ability to be empathetic and be a good listener is key to not only getting more sales but to maintaining a happy workplace.

No matter how good you think you are at communication, you will need to up your game over time.

There are a lot of ways to do that, but it’s critical you pick one, and put some quality effort into getting better.

3. Create a client communication strategy

It’s critical to keep the right notes on your clients, in a way that will facilitate future communication.

Besides the obvious personal info and relevant history, below are a few things you may need to think about (not an exhaustive list):

Communication Frequency

How often will you communicate with the client? This may vary per client.

Communicate too often and they will tire of hearing from you. Communicate too little and they will think you don't care.

Whatever you decide your communication frequency should be, share it with your client and ask if they are good with it?

Ask them if it is too much communication. Show respect for their time and understand that they are being barraged with email and calls as it is.

They will appreciate you asking them and will not feel interrupted when you contact them, since you get their buy in or permission for the communication.

Tone and Style

This may depend on your take-a ways from a client meeting.

What was their tone and communication style?

How can you best be in rapport with your client?

Make sure you understand their method of communication and mirror that to them.

Preferred channels

Do they prefer phone call only? Email and phone call? Skype?

This can seem like a trivial detail, but consider it a part of matching the communication style of your client.

Meet them where they are and you will have a better chance of contacting them.

Event Specific Communication

Is there a birthday or other important event that might trigger a specific communication?

Deliverable

Did you promise anything to the client?

Forms, Product info?

A cool t-shirt with your face on it?

This is critical as you need to follow through on your promises.

Obviously there are endless items you may take notes on.

You will need to identify the most important items for your clients and your specific needs.

Although each client may vary a little, you could likely create a default template that will work with most clients that would really simplify the communication process.

“ If you just communicate, you can get by. But if you communicate skillfully, you can work miracles. ”

- Jim Rohn

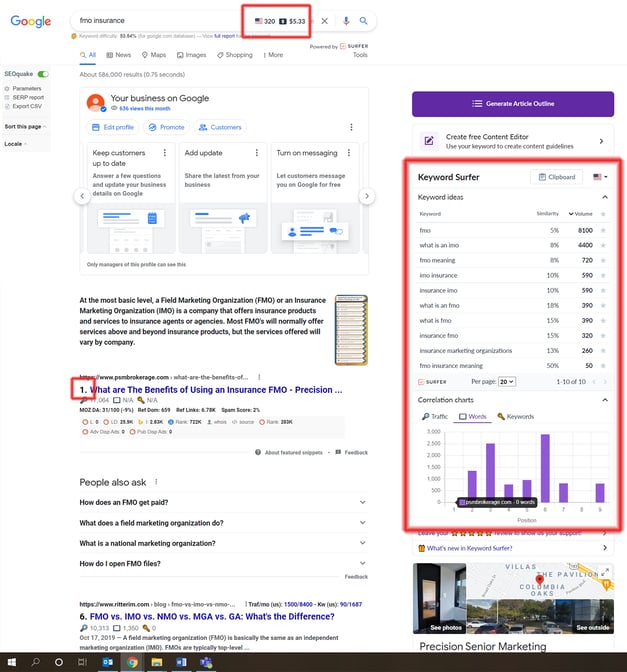

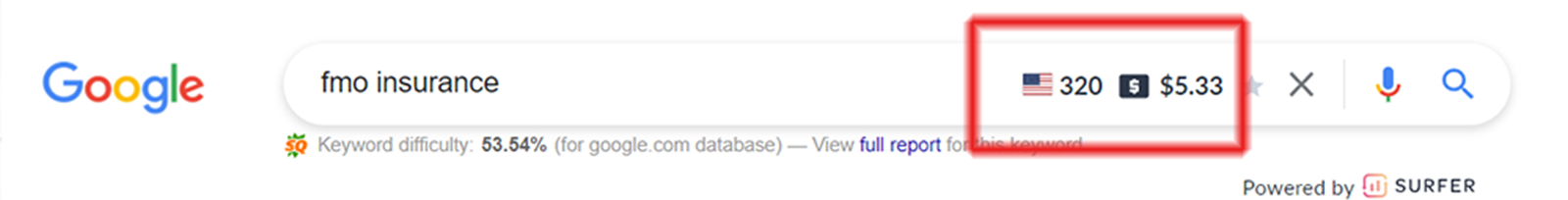

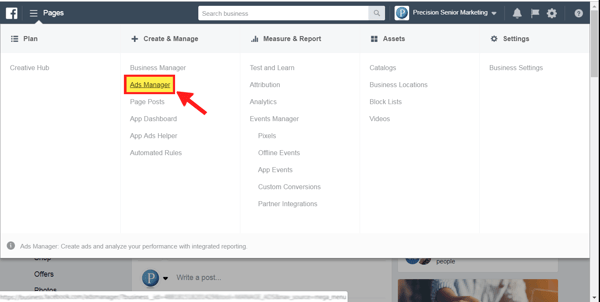

4. Leverage all media channels

There are a number of ways to reach out to your potential clients.

You should experiment with each and decide which work best for your business.

We can break these different ways down into 3 categories: Owned, Earned, and Paid media. Let’s define them real quick.

Owned Media

This includes your brand’s website, blog, social media feeds, and any other media you own and control.

Just to clarify, you may not own a social media platform like Facebook, but you do control your presence on the platform.

Earned Media

This includes channels that are controlled by your customers and media outlets.

This is the media that is spread without you having to pay for it.

Content you share on social media is Earned Media.

Mentions of your Brand on other domains or press coverage is Earned Media, as well as links on other posts that support your brand.

It’s considered earned for obvious reasons. If you want to benefit from it, you have to earn it.

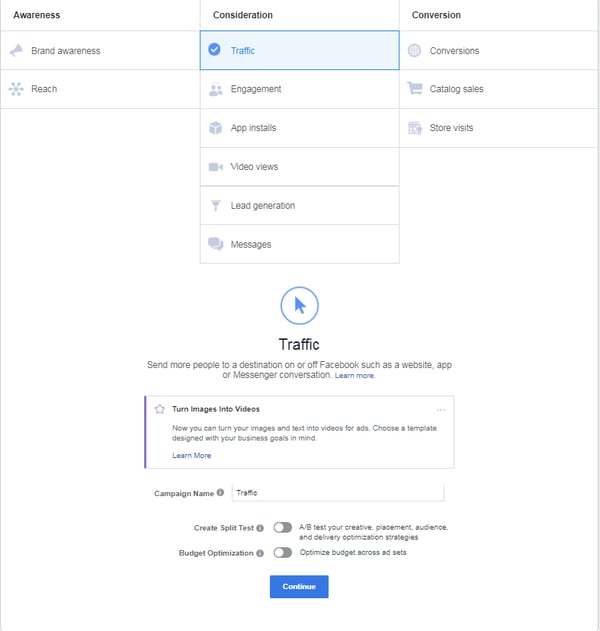

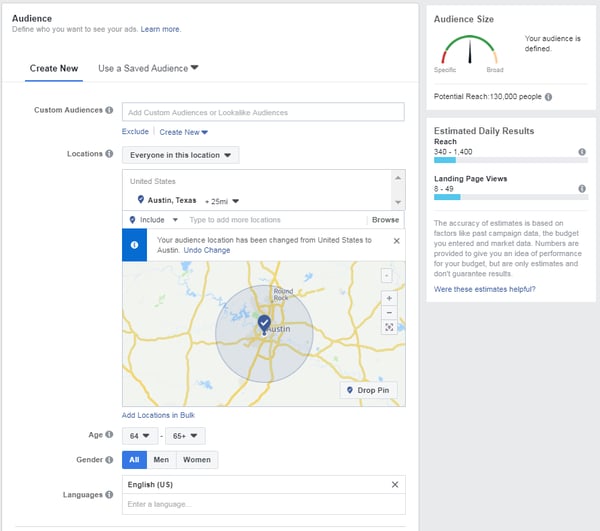

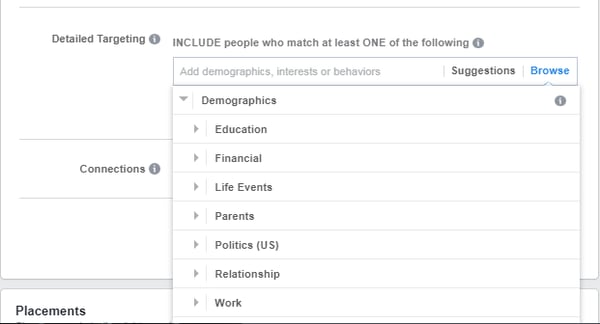

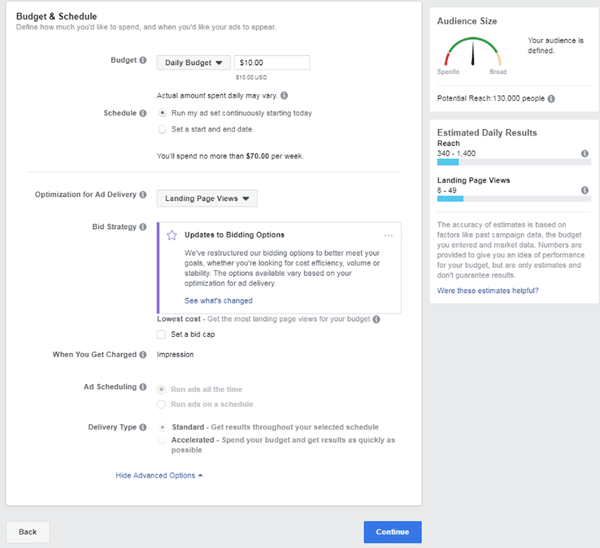

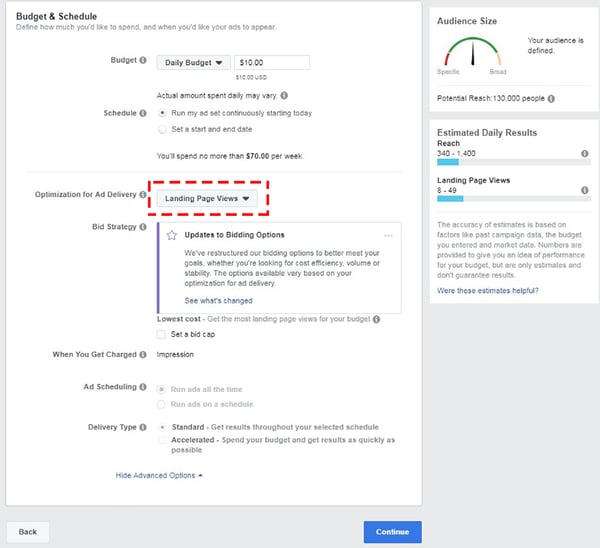

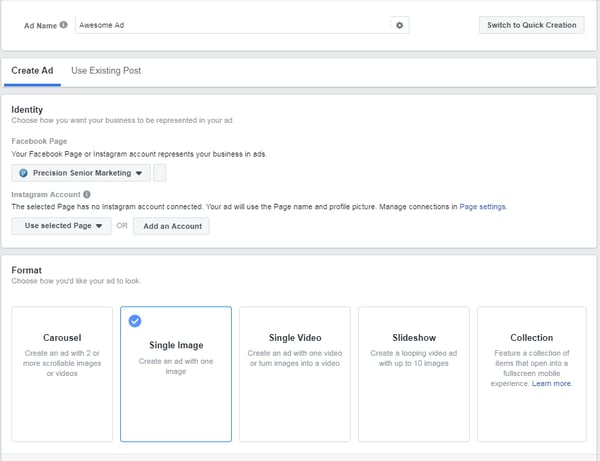

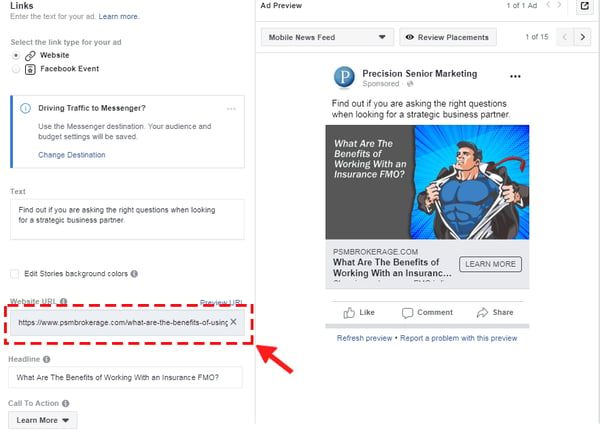

Paid Media

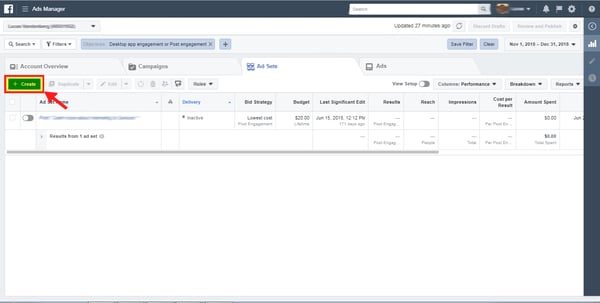

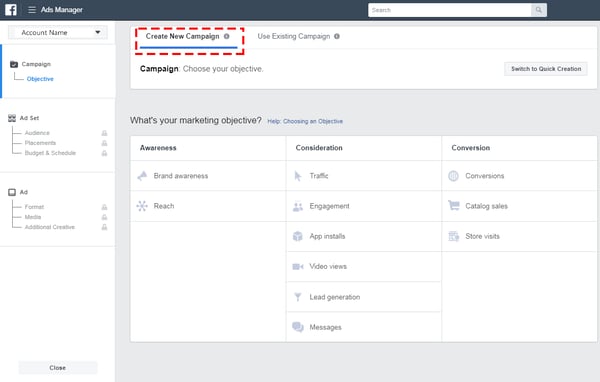

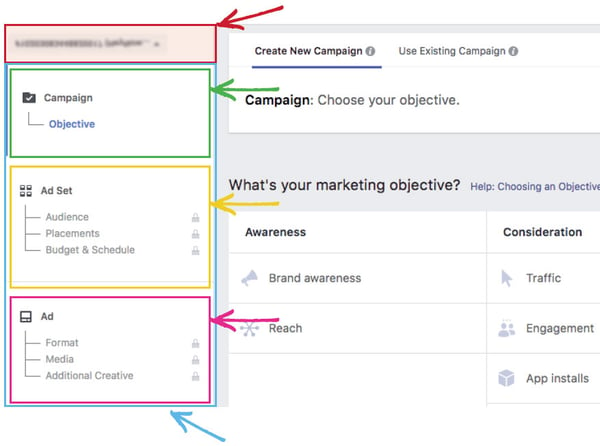

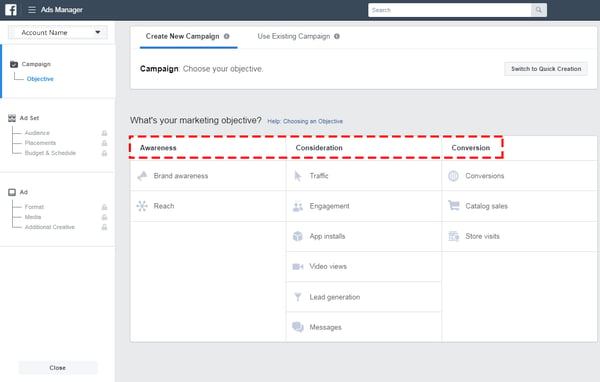

This includes outlets that will promote your brand for a cost.

There are many types of advertisement or sponsored content that fall into this category.

This type of media exists on business owned channels that will not show up organically through web searches or on social media.

They will exist as an ad placement only.

Try as many as you see fit, but don’t use just one.

Use multiple channels and you will find a much greater success.

5. Continue to learn

As an entrepreneur you’re expected to have a knowledge base that covers a lot of ground.

From your own industry to business fundamentals, marketing, communication, and on and on.

Even if you have a solid knowledge of all of those things, everything is changing at hyper speed today.

Luckily online learning has come a long way in recent years.

There are endless ways to study just about any subject, and get it done quickly and inexpensively.

Sites like Udemy and Coursera, among others, have an amazing line up of courses that are very affordable and self paced.

Business technology is also changing at a break neck pace.

Whether it’s a social media platform or a CRM software, you can’t afford to get left behind.

It’s important to understand which of these tools might be right for you and your business needs.

If you don’t, you can be sure your competitors will.

Make learning a lifelong journey and explore what means the most to you and your business.

Stay out in front of coming changes, or you risk getting run over by them.

6. Create a referral system

I’m sure we don’t have to talk about how important referrals are. So, let’s talk about how you get referrals.

For starters, before you can get referrals you have to first be referable. In order to be referable you have to create a first class customer experience.

How do you pick the right referral source?

Maybe it’s a client that is very appreciative of the work you do, or maybe a local business with customers in common that could bring referrals your way.

Make sure your referral sources know how to refer you.

Don’t leave anything to chance.

Give them some content to pass along or send an email detailing how you want your business to be referred.

Give multiple points of contact so customers can find you where they like to communicate. Phone, email, text, Facebook, Linked-In, etc.

This should all be set in a methodical system.

There are software applications that can really streamline this process. Decide what works best for you, just make sure you take the time to do this right.

Don’t forget about an incentive for your referrals.

You want to be referred over and over again, so make it worthwhile to those referring you.

A steady stream of referrals is business gold, and will be pay off big time. Take your time and get this process wired tight.

It’s better to put the time into developing a good referral process than it is to get out there and find new clients by yourself.

“ The purpose of a business is to create customers who create customers. ”

- Shiv Singh

7. Take time to review and evaluate

Since you’ve developed so many good business practices and have been keeping such good data on your clients and prospective clients, you will need to review these processes from time to time.

No strategy lasts very long without needing change.

How will you know if your strategy is working? Should anything be changed, added?

Every year, take some time to view things from a higher perspective. Is what you are doing now going to work next year?

Are there new tools that could help grow your business?

Review your processes objectively and don’t go easy on yourself.

If you see something that could be changed for the better, set goals to change it.

Conclusion

Remember to show off your own unique style that communicates WHY you do what you do. The WHY is what people will connect with.

Put these tactics to work in a meaningful way and you will find customers are much more excited to work with you, bringing you continued business and the success you desire.

We wish you luck on your journey and, as usual, our marketers are always here to help.

Back To Top

|

At PSM, we deeply value the hard work and dedication of our agents. Each year, we extend our appreciation by providing our agents with exceptional marketing programs and opportunities. Additionally, we collaborate closely with our carrier partners to present you with a wide range of enticing incentives and incredible destinations.

At PSM, we deeply value the hard work and dedication of our agents. Each year, we extend our appreciation by providing our agents with exceptional marketing programs and opportunities. Additionally, we collaborate closely with our carrier partners to present you with a wide range of enticing incentives and incredible destinations.

Following Precision Senior Marketing on social media can be a valuable resource for insurance professionals looking to stay informed, learn, and connect within the industry. Hope to connect with you!

Following Precision Senior Marketing on social media can be a valuable resource for insurance professionals looking to stay informed, learn, and connect within the industry. Hope to connect with you!

.png?width=625&height=330&name=How%20to%20Sell%20Medicare%20Advantage%20%26%20Medicare%20Supplement%20Over%20the%20Phone%20(11).png)

%20Client%20Referrals.png?width=275&name=8%20Simple%20Ways%20to%20Get%20More%20(and%20Better)%20Client%20Referrals.png)