|

Precision Senior Marketing is actively engaging with CMS, and subsequently lawmakers in DC, to influence the final language of the proposed rule. The first and primary method to influence the final rule is through the comment letter process. Comment letters on this proposed rule are due to CMS no later than January 5th at 5PM ET. As a critical stakeholder, we encourage you to write your own letter to CMS explaining the significant value that Agents and FMOs provide to American seniors in MA distribution and post-enrollment support. Your efforts here can play a vital role in shaping the final rule that CMS will enact. To help you draft an effective 1-page comment letter, we have provided detailed guidance on yourFMO.com.

NOTE: CMS discounts form / templatized letters – so to ensure the greatest impact of your submission, we have provided bullets for you to consider to include or summarize, in your words, for your own unique letter. This should allow you to craft an impactful letter in as little as 10 minutes.

Will you join us in the effort to protect agents, brokers, and FMOs – and educate Washington on the vital role we play in ensuring consumers are placed in the right plan for their healthcare needs?

|

|||||

Medicare Blog | Medicare News | Medicare Information

URGENT: Take Action to Prevent a CMS Rule Change

Posted by www.psmbrokerage.com Admin on Tue, Jan 02, 2024 @ 02:05 PM

Tags: Medicare Advantage, Medicare Supplement, CMS

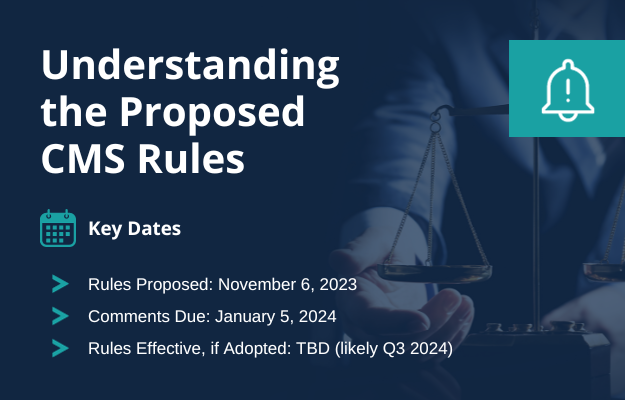

Understanding the Proposed CMS Rules

Posted by www.psmbrokerage.com Admin on Wed, Dec 27, 2023 @ 11:59 AM

|

As you’re aware, CMS recently issued proposed amendments to its regulations governing the 2025 Medicare Advantage Program (MA) and Medicare Prescription Drug Benefit Program (PDP). Click here to read the proposed rules. As conversations about these proposed rules have continued with our partners and throughout our industry, there remains much confusion surrounding the impact these proposed rules may have on our industry. As such, we’ve prepared a FAQ page designed to clarify our interpretation of the rules and how you should view them. This matter impacts everyone. In collaboration with our partners at Amerilife and our Carrier Partners, we are actively engaged in discussions with CMS to convey our concerns about the proposed rule and its negative implications for Medicare. The deadline for submitting comments on the proposed rule to CMS is approaching quickly. We encourage you to take the opportunity to write and send your own letters to CMS and your elected officials to make your voice heard. DEADLINE TO COMMENT IS JANUARY 5, 2024

We appreciate your dedication to serving your clients, and in turn, we are devoted to supporting you. United, we can strive to prevent CMS from implementing this proposed policy. Thanks for your assistance.

|

||||

The Rewarding Path of Selling Medicare Plans as an Independent Insurance Agent

Posted by www.psmbrokerage.com Admin on Thu, Dec 21, 2023 @ 02:48 PM

|

The insurance industry, especially in the realm of Medicare plans, presents a landscape brimming with opportunities for those seeking a blend of autonomy, financial stability, and the satisfaction of providing a valuable service. As an independent insurance agent specializing in Medicare plans, you stand at the forefront of a rapidly growing market, offering vital services to a demographic that is expanding each year: seniors.

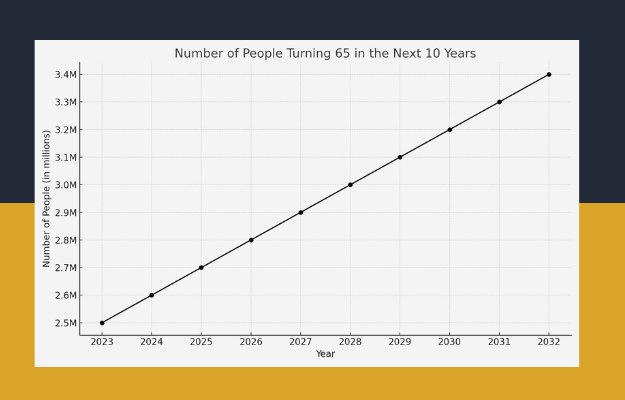

The Expanding Senior Market The demographic landscape of the United States is undergoing a significant shift. With the Baby Boomer generation reaching retirement age, there is an unprecedented increase in the population of seniors. Statistics indicate that by 2030, all Baby Boomers will be over the age of 65, thereby expanding the senior market substantially. This growth translates into a growing need for Medicare plans, tailored to meet the diverse health care needs of the aging population.

Unlike many other professions, where income is directly tied to the hours worked, Medicare plans offer the potential for earning a recurring income on policies sold. This means that each policy sold can continue to provide income for years, compounding over time as you build your client base. This structure offers not only a steady income stream but also the peace of mind that comes with financial stability. Autonomy and Flexibility Being an independent agent means being your own boss. This autonomy allows you to set your own schedule, choose your clients, and create a work-life balance that suits your lifestyle. Whether you prefer to work from home, set up an office, or be on the move, the flexibility inherent in this career path supports a variety of working styles and preferences. This level of independence is particularly appealing to those who thrive in an environment where they can take charge of their business growth and direction.

The satisfaction of providing a service that helps people understand and access the healthcare they need cannot be overstated. It’s a role that not only benefits your clients but also brings a deep sense of personal fulfillment. The opportunity is here! The role of an independent insurance agent selling Medicare plans offers more than just a career; it presents a pathway to a fulfilling, flexible, and financially rewarding profession. In the face of the growing senior market, the ability to generate residual income, and the autonomy of being your own boss, this career path stands out as an excellent choice for those looking to make a positive impact while building a sustainable business. As the population ages, the need for knowledgeable, compassionate, and dedicated Medicare plan agents will only grow, making now an ideal time to step into this rewarding field.

With approximately 10,000 individuals in the United States becoming eligible for Medicare each day, finding the right Field Marketing Organization (FMO) to partner with is crucial for achieving success. PSM goes above and beyond to empower independent agents, agencies, and brokers by offering unparalleled insurance products, exceptional back-office support, and a wealth of valuable tools and resources. We take pride in providing our agents with high quality senior insurance products that bring a sense of security and peace of mind to the nation's exploding senior population. Our experienced insurance marketing team provides our agents with a robust product portfolio, game-changing technology and unrivaled support. We look forward to showing you how we can personalize our services to help grow your business. Precision Senior Marketing was founded in 2006, in Austin, Texas. In the intervening time with almost two decades of experience, PSM has grown to a nationwide footprint, with a mission to empower agents to honestly and ethically help people live longer, healthier and more financially secure lives.

|

||||

Tags: Medicare Advantage, Medicare Supplement, New Business Opportunities

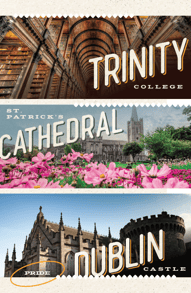

Mutual Sales Leaders 2025 - Dublin

Posted by www.psmbrokerage.com Admin on Thu, Dec 21, 2023 @ 10:07 AM

|

Mutual Sales Leaders 2025 - Dublin Dublin is considered the friendliest city in Europe, if not in the entire world. Kindness and politeness are baked into the city’s honest, down-to-earth culture, which is evident on the cobblestone streets as locals look each other in the eye and salute each other with a jolly “dia dhuit” — or hello. So, channel the Irish spirit of hard work and become an honorary Dubliner by qualifying for Mutual Sales Leaders 2025, where we’ll raise a glass to your success and recognize you for your outstanding achievements. You belong in Dublin in 2025!

The people of Dublin are fiercely proud of their city’s rich history. Dublin was established more than 1,000 years ago on the east coast of Ireland, and many of the places that helped define the traditions, customs and identity of Ireland’s capital still stand today. View Flyer

|

||||||

Your Guide to Marketing Medicare Plans in Your Community

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 01:32 PM

|

|

||

| Newest Blog Posts | All Blog Posts |

Tags: Medicare Advantage, Medicare Supplement, Medicare Part D, Professional Networking, direct mail, Seminar, Marketing, Local

|

Know other independent agents who would thrive in our dynamic environment? Refer them to PSM and earn fantastic incentives! Your success is our success, and together, we'll build a thriving community of agents making a real impact. Download the flyer here.

|

|||||

Tags: Medicare Advantage, Medicare Supplement, referral, Incentives

Why Place Your Medicare Business With Precision Senior Marketing

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:33 AM

|

This $430 credit per 10 sales can be used for initiatives including:

* Street level contract direct to PSM / * Med Supp GI Business not included

|

||

Pre-Approved Medicare Marketing materials

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 11:30 AM

|

Great news! We are here to assist. We are pleased to provide you with a library of pre-approved marketing materials to help you retain and grow your book of business. These pieces have been created to engage consumers and motivate them to consider working with you to meet their Medicare needs. In today's competitive market, it is helpful to have marketing materials that help you stand out with potential clients. We also understand the challenge of coming up with something creative and engaging, in addition to adhering to CMS guidelines. Lucky for you, we have worked with our carrier partners to make sure our agents have access to not only carrier approved marketing materials, but also a library of generic pre-approved Medicare marketing materials. Get your free marketing materials here.

Direct mail is an effective means of driving response among Medicare eligibles. It allows you to target your message to specific people at specific times. Even though direct mail is considered more effective than other mass media options, it is important to do everything you can to help maximize your success. Here are some tips to follow:

Marketing Pieces Include: Age-In, CSNP, DSNP, Educational, Generic and more To request access and speak with a marketing Representative about what pieces are available and how to have the customized, Get your free marketing materials here. You can also call us at 800-998-7715 and speak with one of our friendly marketing representatives. Carrier specific resources available through of our partners: Humana, Aetna, UnitedHealthcare, Cigna

|

Tags: Medicare Advantage, Medicare, Medicare Supplement, direct mail

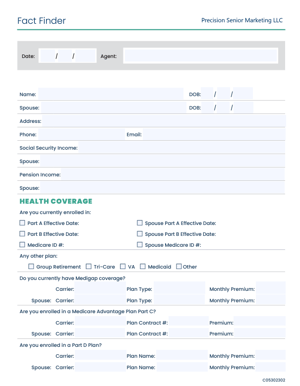

Benefits of Using a Client Needs Assessment Form

Posted by www.psmbrokerage.com Admin on Wed, Oct 04, 2023 @ 12:24 PM

|

Want a custom version with your info and logo? Inquire with your Marketing Representative today and we would be happy to accommodate! Step 1 - Collecting information through a CNA for all your clients is the optimal method to guarantee your ability to offer coverage options and plan selections that align with their present circumstances. Step 2 - Engage in the CNA process to gain insights (or refresh your understanding) into your client's Medicare eligibility, existing coverage, and their primary concerns regarding their healthcare coverage. Step 3 - Utilize the details gathered from the CNA, along with your discussion, to introduce potential plan choices that align with their particular requirements. _____________ By analyzing the assessment form, insurance agents can identify potential coverage gaps in a client's current or desired plan. This allows agents to suggest supplemental plans to fill those gaps. By involving clients in the assessment process, insurance agents educate them about different coverage options, and potential out-of-pocket costs. This empowers clients to make informed decisions about their healthcare.

|

||

|

|

Tags: Medicare Advantage, Medicare Supplement, Medicare Part D, Professional Networking, Marketing

|

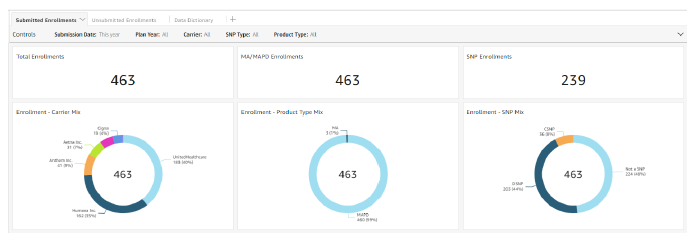

Agent Reporting Agents will have visibility into their production since January 1, 2023. To access this new function, click the graph icon on the left side of your screen and select the “Performance” tab at the top.

This report will showcase:

|

|||||

Tags: Online Enrollment, Medicare Advantage, Medicare Supplement, Part D, SunFireMatrix