|

Don't miss out on the opportunity to enhance your expertise and continue providing valuable service to those navigating their Medicare choices.

|

|||||

Medicare Blog | Medicare News | Medicare Information

Get Ready for 2025 AHIP Medicare Training - June 24th

Posted by www.psmbrokerage.com Admin on Mon, May 13, 2024 @ 11:16 AM

Tags: Medicare Advantage, AHIP, 2025

12 Innovative Strategies for Agents to Expand and Elevate Their Medicare Business

Posted by www.psmbrokerage.com Admin on Wed, May 01, 2024 @ 08:35 AM

|

1. Educational Workshops and SeminarsHost free educational workshops and seminars on topics relevant to Medicare, such as changes in Medicare plans, benefits, or eligibility criteria. These sessions position you as an expert in the field and provide a platform to connect with potential clients. Download our guide on how to market in your local community. 2. Partnerships with Local Businesses and Community CentersForge partnerships with local businesses, community centers, and retirement homes to offer informational sessions or one-on-one consultations. This can broaden your reach and establish a trustworthy presence in the community. 3. Utilize Social Media PlatformsCreate and maintain active social media profiles tailored to the senior demographic. Use these platforms to share useful content, answer FAQs, and broadcast live Q&A sessions. This not only educates but also engages potential clients. Learn more on how you can leverage social media as an insurance agent. 4. Content MarketingDevelop a content marketing strategy that includes blogging, newsletters, ebooks, and infographics. Focus on topics that are beneficial to your target audience, such as understanding Medicare options, managing healthcare costs in retirement, and the latest updates in Medicare policies. Check out the PSM Marketing Hub for marketing ideas. 5. Referral ProgramsImplement a referral program that rewards existing clients for referring new customers. This could be in the form of discounts, gift cards, or special services. Word-of-mouth is a powerful tool in the senior market. 6. Customized Email CampaignsUse email marketing to send personalized communications to your leads and clients. Segment your email list to ensure that the content is tailored to the recipients’ needs and interests, increasing engagement and conversion rates. 7. Expand Your OfferingsConsider obtaining certifications to sell additional products related to healthcare, such as long-term care insurance, dental and vision plans, or supplemental health insurance. This allows you to offer more comprehensive solutions to your clients’ needs. 8. Networking with Healthcare ProvidersNetwork with doctors, nurses, and other healthcare providers who interact with seniors. They can refer patients who might need assistance with Medicare plans. Ensure you leave business cards and brochures that they can easily give to potential clients. Sample provider outreach letter available here. 9. Utilize Client Testimonials and Case StudiesShowcase testimonials and case studies on your website and in your promotional materials. Real-life success stories can significantly enhance credibility and reassure potential clients of your expertise and commitment. 10. Host WebinarsOffer regular webinars on important Medicare topics. This approach not only reaches those who are unable to attend in-person meetings but also allows you to engage with a broader audience from the comfort of their homes. 11. Collaborate with Financial PlannersPartner with financial planners who may have clients approaching the age of Medicare eligibility. This collaboration can be mutually beneficial, as you can refer clients to each other based on the needs of the seniors you serve. 12. Local Sponsorships and AdvertisingSponsor local events or advertise in community newsletters and on local radio stations. Choose venues and media that are popular with the senior demographic to ensure your message reaches the right audience.

|

|||||

Tags: Final Expense, Annuities, Hospital Indemnity, Medicare Advantage, Medicare Supplement, Referrals, cross marketing, cross selling, dental plans

|

Utilizing our insurance agent resource guides can significantly benefit your business by equipping you with the tools and knowledge to thrive in a competitive landscape. These comprehensive guides are designed to help you grow your client base, attract more referrals, and seamlessly expand into new markets. By leveraging up-to-date industry insights, marketing strategies, and detailed market analyses, you can enhance your service offerings and tailor your approach to meet the specific needs of various customer segments. Additionally, our guides offer practical tips on networking and building stronger relationships, ensuring that you not only reach potential clients more effectively but also create lasting connections that foster loyalty and word-of-mouth referrals. With these resources at your disposal, you're well-prepared to elevate your business and secure a prominent position in the insurance industry.

|

|||||

Tags: Final Expense, Hospital Indemnity, Medicare Advantage, Insurance Marketing, Facebook, Goal Setting, DSNP, Enrollment Tools, Guide, Resources

Unlocking Referral Success: Strategic Networking with Healthcare Providers for Medicare Agents

Posted by www.psmbrokerage.com Admin on Tue, Apr 30, 2024 @ 04:47 PM

|

Networking with healthcare providers is a strategic approach for insurance agents looking to expand their referral base. Effective networking can open doors to a steady stream of potential clients who trust their healthcare providers and may therefore trust the referrals they make. Here’s a guide to help you network successfully with healthcare providers and secure valuable referrals: Identify Potential Healthcare ProvidersStart by identifying healthcare providers who frequently interact with Medicare-eligible individuals. This group includes general practitioners, geriatric specialists, cardiologists, endocrinologists, and staff at local clinics, hospitals, and nursing homes. Dentists and pharmacists are also great contacts as they often serve a significant number of senior patients. Understand Their Needs and ConcernsBefore approaching healthcare providers, understand their primary concern: the well-being of their patients. Any discussion about potential referrals should be framed around how you can help their patients navigate Medicare choices more effectively. Be prepared to demonstrate a thorough understanding of Medicare options and the specific needs of seniors. Make the Initial ContactIntroduce yourself professionally via email or letter, briefly explaining your expertise in Medicare and your interest in forming a mutually beneficial partnership. Follow up with a phone call or request an in-person meeting to discuss how you can work together. Download Sample Provider Letter Prepare for the MeetingWhen you secure a meeting, prepare materials that succinctly explain your services, your expertise in Medicare, and testimonials or case studies that showcase your ability to assist seniors with their Medicare needs. Be concise and focus on how your services can add value to the healthcare provider's practice by helping their patients. Offer Value and EducationOffer to provide educational workshops or seminars for the provider’s patients about Medicare options. You can also create informative brochures or flyers that the provider can share with their patients. Make sure these materials are clear, professional, and free of overt sales pitches. Be a Resource, Not a SalespersonPosition yourself as a resource rather than a salesperson. Make it clear that your primary goal is to educate and assist patients in making informed Medicare choices. This approach is more likely to earn the trust and respect of healthcare providers. Follow Up RespectfullyAfter your initial meeting, follow up with a thank-you note expressing your appreciation for their time and reiterating how you can assist their patients. Keep the lines of communication open by checking in periodically with updates on Medicare or additional resources you can offer. Maintain Professionalism and IntegrityAlways maintain a high level of professionalism and integrity. Ensure that all interactions with healthcare providers and their patients adhere to the highest ethical standards. Respect patient privacy and comply with all relevant regulations, including HIPAA. Evaluate and Adapt Your ApproachRegularly evaluate the effectiveness of your networking efforts. If certain approaches or messages don’t seem to resonate, be prepared to adapt your strategy. Ask for feedback from healthcare providers about how you can better meet their needs and the needs of their patients. Build and Nurture the RelationshipTreat every interaction as a step towards building a long-term relationship. Send regular updates about changes in Medicare, new services you offer, and general news that may affect their patients. Consider organizing occasional networking events or casual meet-ups to keep the relationship strong and active.

|

|||||

Tags: Referrals

Earn Extra Cash with LifeShield’s Survivor Cash for Apps Bonus Program!

Posted by www.psmbrokerage.com Admin on Mon, Apr 29, 2024 @ 03:49 PM

|

Earn Extra Cash with LifeShield’s Survivor Cash for Apps Bonus Program!

|

||||

Tags: Final Expense, Bonus Program, LifeShield

|

For insurance agents specializing in the senior market, cross-selling additional products to Medicare enrollees is a powerful strategy to enhance value for clients while boosting your business’s profitability. With the right approach, you can effectively address the comprehensive needs of seniors, who often require more than just health insurance to feel secure. Here’s a look at how you can excel in cross-selling by expanding your portfolio beyond basic Medicare plans. Understanding the Needs of Your ClientsSeniors have unique needs and concerns that extend beyond healthcare. Issues such as long-term care, dental health, vision, and even financial security are critical. By understanding these needs, you can tailor your cross-selling strategies to offer comprehensive solutions that resonate deeply with your clients. Popular Cross-Sell Products to Consider:

Tips for Effective Cross-Selling

|

|||||

Tags: Final Expense, Annuities, Hospital Indemnity, cross selling, dental plans

Leveraging Social Media as an Insurance Agent

Posted by www.psmbrokerage.com Admin on Thu, Apr 25, 2024 @ 11:01 AM

|

In today's digital world, social media is a powerful tool that insurance agents can utilize to build relationships, enhance visibility, and ultimately grow their business. With billions of users across platforms like Facebook, Instagram, LinkedIn, and Twitter, social media provides a unique opportunity for agents to connect with a diverse audience. This guide will show how insurance agents can effectively leverage social media to reach potential clients and establish a strong online presence.

|

|||||

2024 NABIP Texas Annual Conference Recap

Posted by www.psmbrokerage.com Admin on Thu, Apr 25, 2024 @ 09:31 AM

|

On behalf of PSM Brokerage, we extend our heartfelt thanks to each of you who participated in this year's NABIP-TX Annual Conference for insurance agents. Your presence and engagement made the event a resounding success! We hope you found the sessions enlightening and beneficial, especially the insights on how to build an effective team, and the valuable discussions on understanding loss ratios, company data, and managing carrier books of business. The focus on Senior Dental Plans and the artful strategies behind Cross Selling provided tools that will help you secure and expand your client base.

Additionally, we hope the in-depth sessions on leveraging social media effectively with JoAnna Barker and understanding the evolving landscape of 2025 Marketing Rules and CMS Regulations with Danielle Kunkle Roberts have equipped you with the necessary skills to optimize your marketing efforts and stay compliant in your practices.

The insights provided by Greg Segovia III on the Ins and Outs of an FMO relationship and Sydney Schoellman’s guidance on navigating the escalation path with your carriers are crucial tools for enhancing your business operations and improving your professional interactions. These sessions were designed to give you a comprehensive toolkit for tackling the complex challenges of today’s insurance market, ensuring that you are well-prepared to meet and exceed your professional goals. Your enthusiasm and active participation are what drive PSM to sponsor these unique and proprietary learning experiences. We are thrilled to support your journey as you implement some of these strategies to grow and scale your businesses. Thank you once again for your participation and for making the conference a memorable gathering. We look forward to seeing you next year with even more engaging content and networking opportunities to help you succeed in the dynamic world of insurance.

|

|||||

Tags: Hospital Indemnity, Medicare Advantage, Insurance Marketing, Facebook, Goal Setting, DSNP, Enrollment Tools, Guide, Resources, NABIP

3 Big Medicare Changes for 2025

Posted by www.psmbrokerage.com Admin on Wed, Apr 24, 2024 @ 11:41 AM

|

By Fortune – April 22, 2024 It may be months before the calendar flips to 2025, but not for Medicare. The Centers for Medicare & Medicaid Services (CMS), which runs the program, just announced two major changes for 2025 you’ll want to know about. Next year, Medicare will also dramatically alter the maximum amount beneficiaries will need to pay out-of-pocket for their covered medications. Read the article.

|

||||

Tags: Medicare Advantage, CMS

Shine brighter than ever when you sell Med Supp with Mutual of Omaha

Posted by www.psmbrokerage.com Admin on Tue, Apr 23, 2024 @ 09:18 AM

|

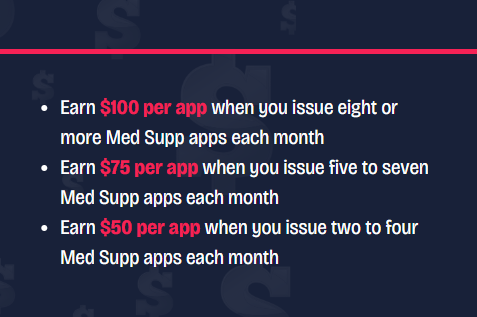

Put on your shades and brace yourself for a dazzling Medicare supplement sales opportunity that's so stunning it'll get your full attention. Your time to shine starts soon. With each Med Supp sale you make from May 1 through July 31, you're not just brightening your sales outlook — you're one step closer to winning one of these sparkling cash rewards:

|

|||||

Be sure to mark your calendars for

Be sure to mark your calendars for