|

For financial professional use only. Not for use with the general public.

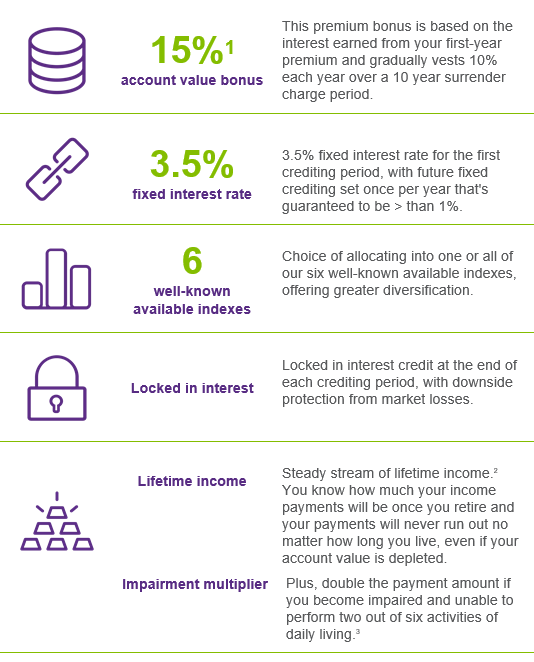

1For issue age 75 and under in most states. Subject to change. The premium bonus is automatically included with Performance Pro for an annual rider fee of .10%. See the Statement of Understanding for complete details.

2For a fee.

3If specific qualifications for impairment are met (see rider for details) and the Account Value is greater than zero, withdrawal payments increase by 2X (1.5X if joint contract).

“F&G” is the marketing name for Fidelity & Guaranty Life Insurance Company issuing insurance in the United States outside of New York. Life insurance and annuities issued by Fidelity & Guaranty Life Insurance Company, Des Moines, IA.

Guarantees are based on the claims paying ability of the issuing insurer, Fidelity & Guaranty Life Insurance Company, Des Moines, IA.

The premium bonus is calculated based on the first year premium and vests according to a vesting schedule over the duration of the surrender period.

This is a fixed deferred indexed annuity providing minimum guaranteed surrender values. You should understand how the minimum guaranteed surrender values are determined and the product features used to determine the values. Even though contract values may be affected by external indexes, the contract annuity is not an investment in the stock market and does not participate in any stock, bond or equity investments.

Interest rates subject to change at insurer’s discretion and are effective annual rates.

Annuities that offer a vesting bonus may have higher fees, longer surrender charge periods, lower interest crediting rates, lower participation rates, lower cap rates and higher spreads than annuities without vesting bonuses.

The provisions, riders and optional additional features of this product have limitations and restrictions, may have additional charges, and are subject to change.

23-1518

|