|

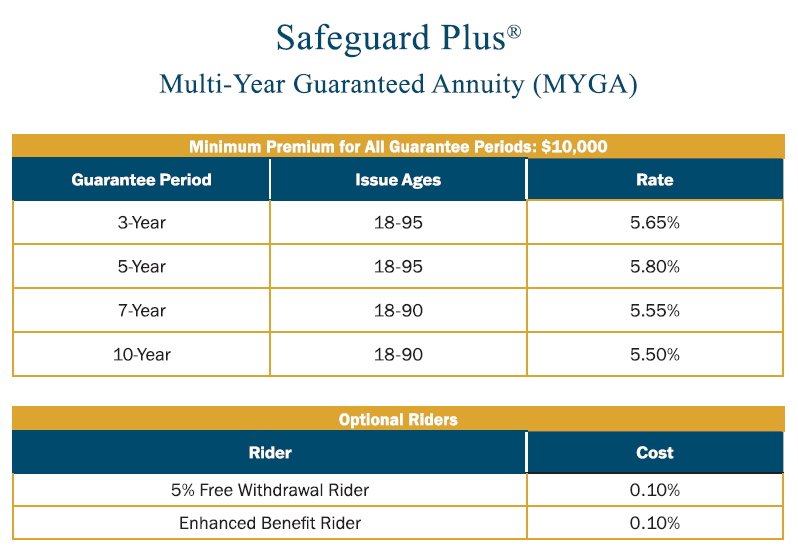

A Safeguard Plus® MYGA from Farmers Life Insurance Company is a single premium deferred fixed annuity that offers predictable interest earnings for a specified Regardless of their savings timeline, clients can also benefit from:

|

||||

Medicare Blog | Medicare News | Medicare Information

Product Spotlight: Safeguard Plus

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 01:29 PM

What should you expect working with an Annuity IMO

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:25 PM

|

AN IMO/FMO specializing in annuities is a key player in the insurance and financial services industry, serving as an intermediary between insurance carriers or financial institutions and independent agents or financial advisors. An Annuity IMO offers critical support to agents and advisors focused on selling annuities, which are financial products designed to provide a stream of income for clients during retirement. Here are the primary functions and roles of an Annuity IMO: Product Expertise: Provide agents and advisors with in-depth knowledge about various types of annuities, such as fixed annuities, variable annuities, and indexed annuities. This knowledge enables agents to assist clients in selecting the most suitable annuity products. Carrier Contracts: Assist agents in contracting with multiple insurance carriers or financial institutions that offer annuities. This broadens the range of annuity products agents can offer to clients. Education and Training: Offer ongoing education and training programs to ensure agents stay current with the latest annuity products, regulations, and sales techniques. Sales Support: They often provide marketing materials, sales tools, and guidance on effective strategies for selling annuities. Commission Management: They assist agents in tracking and managing commissions, ensuring agents are fairly compensated for their sales efforts. Compliance Assistance: Help agents navigate regulatory requirements and compliance issues related to annuity sales. Market Insights: They may provide agents with market insights, trends, and data to help them make informed decisions and adapt their sales strategies to changing market conditions. Client Support: Some offer post-sale support to clients, helping address their questions and concerns related to their annuity contracts. An Annuity IMO plays a crucial role in helping agents and advisors serve their clients by offering comprehensive product knowledge, compliance guidance, marketing support, and a broad range of annuity options. This support benefits both the agents and their clients by ensuring that annuity sales are conducted ethically and professionally, leading to well-informed investment decisions for those seeking retirement income solutions. Check out our Agent Programs and Services Guide to learn more about PSM and the services we proudly offer the agents we work with.

|

MYGA Cross-Marketing Letter for Medicare Clients

Posted by www.psmbrokerage.com Admin on Mon, Jul 31, 2023 @ 02:54 PM

Selling annuities can offer numerous advantages in today's insurance industry, allowing insurance professionals to fulfill their clients' financial security and peace of mind objectives. While you may already provide a range of insurance products, exploring the sale of annuities can be highly beneficial.

View Sample Prospecting Letter |

||

| Newest Blog Posts | All Blog Posts |

Check out our latest MYGA Rates and Resources

Posted by www.psmbrokerage.com Admin on Mon, Jul 31, 2023 @ 10:53 AM

|

Selling annuities can offer numerous advantages in today's insurance industry, allowing insurance professionals to fulfill their clients' financial security and peace of mind objectives. While you may already provide a range of insurance products, exploring the sale of annuities can be highly beneficial.Explore our complete multi-year guarantee annuity rate table and learn more about PSM's extensive selection of fixed annuities.

Remember, selling fixed annuities involves working with individuals' financial well-being, so it's crucial to act ethically, provide accurate information, and always prioritize the best interests of your clients. You can review our Annuity Product Portfolio here. You can also call us at 800-998-7715 and speak with one of our marketing representatives to assist with any questions.

|

||||

| Newest Blog Posts | All Blog Posts | ||||

The New 60/40: Replacing Bonds with Fixed Indexed Annuities

Posted by www.psmbrokerage.com Admin on Mon, Jul 17, 2023 @ 03:16 PM

|

Financial market upheavals and bank instability have left Americans feeling uncertain about the safety of their money. Recent failures of large banks have had a mobilizing effect on investors nationwide. American consumers, now fearful of depositing money into their once-trusted bank accounts, are in search of safe havens for their money.But it wasn’t just the recent banking failures that caused concern. As the Federal Reserve raised interest rates, banks didn't do the same for depositors. Deposits overall had been in a steady decline over the past year. Combined with rising interest rates, less competitive investment rates for bank accounts offering next to nothing returns and the fear of further failures, many people have decided to park their money elsewhere.Fortunately, there are ways to protect and grow your clients’ hard-earned and astutely saved assets without taking on too much risk: Replacing volatile traditional bank bonds with more durable and dependable fixed indexed annuities (FIA).FIAs pay an interest rate based on the performance of a market index, such as the S&P 500. However, money isn't invested or exposed to the market. It’s a blend of other annuity types and applies beneficial elements of each. The FIA offers the protection of a fixed annuity with the potential for growth like the index annuity.What is the old 60/40? The old 60/40 portfolio is a 71-year-old investment strategy, first proposed by Nobel Laureate Harry Markowitz in 1952. The strategy involves investing 60% of a portfolio in stocks and 40% in bonds. It's an easy-to-follow approach to diversifying investments — but it comes with a significant amount of market risk. The 60/40 has been popular for decades, but with recent changes in the financial landscape, it may be time to rethink our strategy. In “The New 60/40,” you’re replacing bonds with FIAs, which can offer more market protection and more robust growth opportunities. For example, whereas bank CDs carry a 3% to 10% financial reserve, FIAs are a 100% financial reserve product, which allows investors to access all their funds at any time, without any restrictions or limitations. Being a 100% financial reserve product allows investors to keep their funds in a safe, secure and liquid form, while still earning an attractive return. A 100% financial reserve product offers investors the ability to access their funds immediately and with no hidden costs or fees. FIAs can help clients protect their principal and generate market-like gains without financial market risk. They can help to generate important retirement income without having to withdraw funds from the growth portion of a portfolio. This makes FIAs an attractive option for those looking to protect their retirement savings and build income.

Remember, selling fixed annuities involves working with individuals' financial well-being, so it's crucial to act ethically, provide accurate information, and always prioritize the best interests of your clients. You can review our Annuity Product Portfolio here. You can also call us at 800-998-7715 and speak with one of our marketing representatives to assist with any questions.

|

||||

| Newest Blog Posts | All Blog Posts | ||||

.png?width=400&height=400&name=Learn%20MORE%20(1).png)