MACRA stands for Medicare Access and CHIP Re authorization Act of 2015. It is often referred to as MACRA 2020 because, while it was signed into law in 2015, it went into effect on January 1st, 2020.

In this article we will review the changes and what those changes mean to you as an agent. So grab a coffee and settle in while we review this important subject.

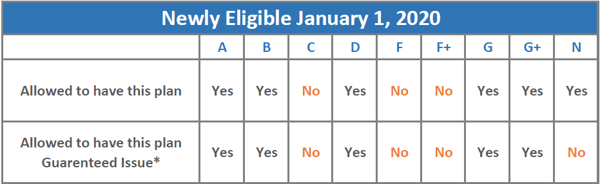

Changes to MACRA will prohibit first dollar, out of pocket coverage of all claims on plan F, high deductible Plan F and Plan C, requiring newly eligible Medicare beneficiaries to pay some of the cost of their medical care that was once covered entirely by one of these plans.

Changes to MACRA will prohibit first dollar, out of pocket coverage of all claims on plan F, high deductible Plan F and Plan C, requiring newly eligible Medicare beneficiaries to pay some of the cost of their medical care that was once covered entirely by one of these plans.

Section 401 of MACRA prohibits the sale of Med Supp policies covering Part B deductibles to newly-eligible Medicare beneficiaries. Be aware, there are penalties for selling prohibited policies to newly eligible Medicare beneficiaries.

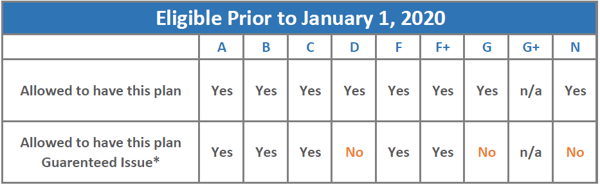

“Newly eligible” is defined as people who turn 65 (or otherwise qualify) on, or after, the law goes into effect, or who first become eligible for Medicare after January 1st, 2020.

It is important to note that individuals that are Medicare eligible as of December 31st, 2019, as well as current Plan F & C owners, will retain their right to continue enrolling in Plans F and C after that date.

Said another way, if a consumer is eligible for Medicare prior to January 1st 2020, they may still purchase Plan F & Plan C beyond that date.

Guarantee Issue plans D, G, and high deductible G, (new) will be available for newly eligible beneficiaries, in the absence of Plans F & C.

Over time the number of people Medicare eligible as of December 31, 2019 will shrink.

There has been some speculation of extreme rate increases for Plan F due to the changes on the horizon.

Although rate increases are possible, we have no reason to believe that extreme rate increases are imminent.

Based on studies of previously closed blocks of business, there is no support for the belief that MACRA regulations would result in an “assessment spiral” in Plan F blocks.

Any concerns about extreme rate increases appear to be misguided and may be creating unnecessary fear in the Med Supp marketplace.

From 2010 -2017 “first dollar” plans (Plans F & C) have seen a slight decline from 66.8% to 63.5%, while Plan G and N have increased their share dramatically from 5% to 22.5%.

From 2010 -2017 “first dollar” plans (Plans F & C) have seen a slight decline from 66.8% to 63.5%, while Plan G and N have increased their share dramatically from 5% to 22.5%.

We expect that MACRA will help continue these trends over a period of years to come.

For newly eligible Medicare beneficiaries who can no longer purchase Plan F or Plan C after December 31st, 2019, Plan D and Plan G will become the new “Guaranteed Issue” plans of choice.

In the transition away from Plan F and Plan C, Plan D and G will be required to accept Guaranteed Issue beneficiaries – people who, under certain circumstances, have the right to purchase a Med Supp policy despite having pre-existing conditions.

Clients already enrolled in Medicare, many of whom will be reluctant to move from Plan F, will now have a reason to explore different plan options.

We expect that these new options will include a lower cost, “next generation” Plan F, developed to address the needs of clients already Medicare-eligible, or who become eligible before the end of the year.

We feel that Plan N will become a strong value play for consumers, and that sales of Plan G will gradually decrease once prices begin to reflect the impact of a higher OE and GI business.

Plan N may even become the new plan of choice, or, the “new plan G” – that is, a less expensive alternative to the most popular plan. Remember, Like Plan C, Plan N does not cover Medicare Part B excess charges.

For clients new to Medicare, they will have clearer, more competitive product choices across the board.

Although MACRA will not affect Medicare Advantage Plans directly, we thought it prudent to mention MA here, just to clarify it's place in the market.

MA plans, for many reasons, appeal to a newer generation of the Medicare eligible who seek wellness options and a fee based model. We don’t expect this trend to stop with or without the changes MACRA will implement.

Medicare Advantage (MA) plan enrollment has increased by an average of 10 percent annually over the past 14 years.

MA’s share of the market has continued to grow as well, from 13% in 2004 to 34% in 2018. MA’s market share is projected to increase to 42% by 2028.

Carriers, agents and clients should all be mindful of MA’s place in the Medicare product mix.

It’s estimated that the number of retirees will grow from 50 million today, to about 72 million by 2035.

It’s estimated that the number of retirees will grow from 50 million today, to about 72 million by 2035.

With the changes we’re seeing in the market, clients will especially value working with a trusted knowledgeable agent or advisor. As an agent, you have an opportunity to gain a higher level of trust by guiding them through the confusing transition periods.

As of Jan. 1, 2020 people turning 65 will no longer have Plan F or C as options. This will change the plan mix to about 80 percent underwritten, allowing carriers to lower their rates for Plan F.

This will create an opportunity for agents to offer clients with Plan F the chance to save money while keeping the same coverage.

Agents can benefit from what will become a revitalized sales environment.

There will be new products and new pricing structures to talk about, as the MACRA changes encourage new carriers to enter the market, and motivate existing carriers to offer more competitive plans.

The future belongs to those agents who are able to understand the changes and help their clients pivot to Medigap or MA plans, as needed.

As always, our marketers are here to help with any questions or challenges you may have.

©2024 Precision Senior Marketing | 11940 Jollyville Rd #200 South, Austin TX 78759 | Phone: (800) 998-7715

*“Not affiliated with the U. S. government or federal Medicare program. This website is designed to provide general information on Insurance products, including Annuities. It is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that PSMBrokerage, its affiliated companies, and their representatives and employees do not give legal or tax advice. Encourage your clients to consult their tax advisor or attorney.