|

Would you like to make more Medicare Supplement sales? We have several product features to make your job easier, such as our Innovative Plan G.

This — plus our other features — gives our agents the advantage in today’s market. What are you waiting for? Join the Physicians Mutual family! Ask us for details on what sets Physicians Mutual apart from the competition — and why you won’t want to sell others' products. You won’t regret it! To request details, Please call us at 800-998-7715 or click on the link below.

For recruiting purposes only. Products/features vary by state.

|

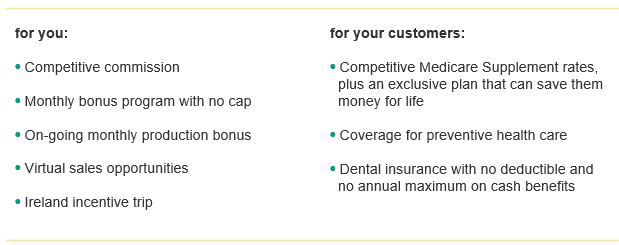

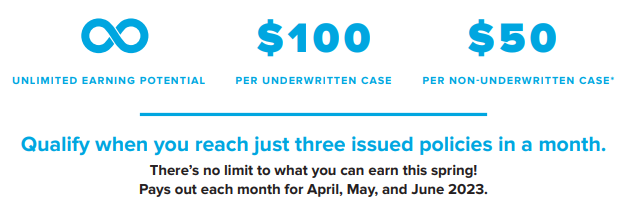

Aflac Q2 Bonus Opportunity. Check out the details here.

Aflac is here to help manage your client's health care expenses with coverage they can count on. Now is a great time to add this well respected brand to your portfolio.

Aflac announced the introduction of two new consumer-directed products: Aflac Final Expense Whole Life Insurance and Aflac Medicare Supplement Insurance. These products — underwritten by Tier One Insurance Company, a subsidiary of Aflac Incorporated — are part of a robust portfolio of supplemental coverage options.

While Medicare provides coverage for health-related expenses, it doesn't cover all costs — such as copayments, coinsurance and deductibles. Because consumers need a way to help manage expenses during retirement, Aflac introduced its Medicare Supplement Insurance policies to help fill some of these coverage gaps.

Aflac Final Expense Whole Life Insurance

With Aflac Final Expense Whole Life Insurance, policyholders can help protect their loved ones' financial security by helping to pay for end-of-life expenses not covered under Medicare and other programs, while also encouraging families to address uncomfortable discussions about final expenses.

|

Aflac Final Expense Insurance: Coverage may not be available in all states including but not limited to NM or NY. Benefits/premium rates may vary based on coverage selected. Optional riders may be available at an additional cost. Policies have limitations and exclusions that may affect benefits payable. Refer to the specific policy and rider form(s) for complete details, definitions, limitations and exclusions. In AR, ID, OK, OR, PA, TX and VA: Policies ICC21-AFLLBL21 and ICC21-AFLRPL21; and Riders ICC21-AFLABR22, ICC21-AFLADB22, and ICC21-AFLCDR22. Aflac Final Expense insurance coverage is underwritten by Tier One Insurance Company, a subsidiary of Aflac Incorporated and is administered by Aetna Life Insurance Company. Aflac Medicare Supplement Insurance policy series AFLMS. Coverage not available in all states, including but not limited to NM or NY. Some plans may be available to qualified consumers under age 65. Plans not available in all states. Benefits/premium rates will vary based on coverage selected. For complete details of benefits, definitions, and exclusions, please carefully read the outline of coverage and policy forms, and refer to the "Guide to Health Insurance for People with Medicare." Aflac Medicare supplement insurance is not connected with or endorsed by the U.S. government or the federal Medicare program. All benefits payable under the policy are based upon Medicare-eligible expenses (as applicable). In Idaho, policies AFLMSP22A-ID, AFLMSP22F-ID, AFLMSP22G-ID, AFLMSP22N-ID. In Oklahoma, policies AFLMSP22A-OK, AFLMSP22F-OK, AFLMSP22G-OK, AFLMSP22N-OK. In Virginia, policies AFLMSP22A-VA, AFLMSP22F-VA, AFLMSP22G-VA, AFLMSP22N-VA. Aflac Medicare Supplement insurance coverage is underwritten by Tier One Insurance Company, a subsidiary of Aflac Incorporated, and is administered by Aetna Life Insurance Company. 1021 Reams Blvd, Franklin, TN, 37064; |

To help our customers save money, we developed an exclusive Innovative Plan [G] — which saves them money on premiums for life and gives YOU the competitive edge.

To help our customers save money, we developed an exclusive Innovative Plan [G] — which saves them money on premiums for life and gives YOU the competitive edge.

Cutting-Edge Products | Access to patented

Cutting-Edge Products | Access to patented