A Guide to Selling Final Expense Insurance A Guide to Selling Final Expense Insurance

Why Sell Final Expense Insurance?

Final expense plans, also referred to as burial insurance or funeral insurance, are specialized life insurance policies that cater to the expenses associated with a policyholder's final arrangements.

This includes covering funeral and burial costs, medical bills, and other end-of-life expenses. These policies are typically whole life insurance with lower face values compared to traditional life insurance, making them more accessible and affordable to individuals of all ages and health conditions.

What sets final expense plans apart is the ease of qualification, as they often do not require medical exams. Instead, applicants usually need to answer a few health-related questions to determine their eligibility.

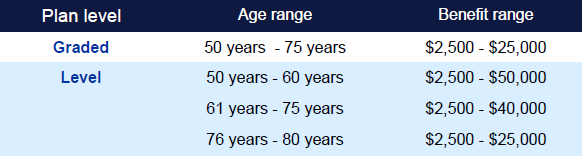

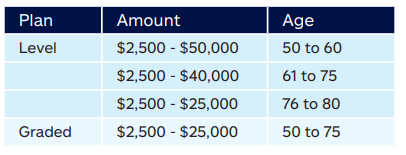

This makes final expense insurance an appealing choice for seniors or those with pre-existing health conditions. The face value of final expense policies can vary from a few thousand dollars to tens of thousands of dollars, depending on the coverage amount selected.

The primary aim of these policies is to provide policyholders with financial peace of mind, ensuring that their loved ones are not overwhelmed by the significant expenses that typically accompany end-of-life arrangements.

Additionally, final expense plans often come with a guaranteed cash value component, allowing policyholders to accumulate cash value over time that can be accessed if needed during their lifetime.

Furthermore, these policies usually have level premiums, meaning that the premium remains constant throughout the policyholder's life, providing a stable and predictable payment structure.

When agents sell final expense plans, they must approach the topic with empathy and sensitivity, recognizing the emotional nature of end-of-life planning. By offering comprehensive information and personalized assistance, agents can help individuals and their families make well-informed decisions about selecting the most suitable final expense policy that aligns with their financial needs and preferences.

Ultimately, final expense plans serve as a valuable tool in ensuring that policyholders can leave behind a lasting legacy while alleviating the financial burden on their loved ones during a difficult time.

Best Practices for Selling Final Expense Insurance?

Final expense plans, also known as burial insurance or funeral insurance, are specialized life insurance policies designed to cover the costs associated with a policyholder's final expenses, such as funeral and burial costs, medical bills, and other end-of-life expenses.

These policies are typically whole life insurance with lower face values compared to traditional life insurance, making them more affordable and accessible to individuals of varying ages and health conditions.

One of the key benefits of final expense plans is the ease of qualification, as they often do not require medical exams. Instead, applicants typically answer a few health-related questions to determine their eligibility.

This makes final expense insurance an attractive option for seniors or individuals with pre-existing health conditions. The face value of final expense policies typically ranges from a few thousand dollars to tens of thousands of dollars, depending on the coverage amount chosen.

These policies aim to provide financial peace of mind to policyholders, ensuring that their loved ones are not burdened with the substantial expenses that often accompany end-of-life arrangements.

Additionally, final expense plans often have a guaranteed cash value component, allowing policyholders to build cash value over time that can be accessed during their lifetime if needed.

Furthermore, these policies usually have level premiums, meaning the premium remains the same throughout the policyholder's life, providing a stable and predictable payment structure. When selling final expense plans, agents must approach the topic with empathy and sensitivity, recognizing the emotional nature of end-of-life planning.

By providing comprehensive information and personalized assistance, agents can help individuals and their families make informed decisions about selecting the right final expense policy to suit their financial needs and preferences.

Overall, final expense plans serve as a valuable tool in ensuring that policyholders can leave behind a lasting legacy while alleviating the financial burden on their loved ones during a difficult time.

Sample Final Expense Sales Script

As a final expense agent, having a well-crafted script can help guide your conversations with potential clients and ensure you cover all essential points.

Below is a sample script that you can use as a starting point.

Introduction:

Agent: Hi, [Prospect's Name]. My name is [Your Name], and I specialize in helping individuals plan for their end-of-life expenses with final expense insurance. How are you today?

Prospect: I'm doing well, thank you. Agent: That's great to hear! I'm reaching out today because I believe having financial security for your final expenses is essential for peace of mind. With your permission, I'd like to ask a few questions to better understand your needs and explore the options available to you. Is that okay? Prospect: Yes, go ahead.

Needs Assessment:

Agent: Wonderful! Let's start by discussing your financial goals and any concerns you may have about planning for your end-of-life expenses. Have you considered final expense insurance before?

Prospect: I've heard about it but haven't looked into it much.

Agent: Not a problem. Final expense insurance is designed to cover the costs associated with funeral and burial expenses, medical bills, and other end-of life costs. It's a way to ensure that your loved ones are not burdened with these expenses during a difficult time. Now, may I ask, what are your thoughts on planning for these expenses?

Sample Script Explaining Final Expense Insurance:

Agent: Final expense insurance is a whole life insurance policy with lower face values, making it more affordable for individuals. It offers a guaranteed death benefit, and the premiums are typically level, meaning they stay the same throughout the life of the policy. Plus, it's easier to qualify for, as there are often no medical exams, just a few health-related questions.

Coverage Options:

Agent: We offer final expense policies with coverage amounts ranging from a few thousand dollars to tens of thousands of dollars. The coverage amount you choose will depend on your specific needs and the expenses you want to cover.

Customizing the Policy:

Agent: I want to ensure we find the best solution for you. By understanding your financial situation and end-of-life wishes, we can tailor the policy to meet your needs and budget. May I ask, what coverage amount would you be comfortable with?

Prospect: I think covering [specific expense] and having some extra for my family would be ideal. Agent: That's a wise decision. I can certainly help you with that. Let's explore some policy options that align with your preferences.

Addressing Concerns:

Agent: Do you have any concerns or questions about final expense insurance that I can address for you?

Prospect: How do the premiums work, and can I access the cash value if needed? Agent: Great questions! With final expense insurance, the premiums are typically level, meaning they won't increase as you get older. As for the cash value, certain policies do build cash value over time, and you can access it if needed during your lifetime. I'll make sure to present policies that offer these features.

Providing Recommendations:

Agent: Based on our conversation, I recommend a policy with [specific coverage amount] and [additional features, if applicable]. This policy will provide you with the coverage you need while keeping the premium affordable. What do you think about this option?

Next Steps:

Agent: If you're ready to move forward, I can assist you with the application process, answer any additional questions you may have, and ensure a smooth enrollment experience. We can get started right away.

Closing:

Agent: [Prospect's Name], my goal is to provide you with peace of mind knowing that your final expenses are taken care of. When you're ready, we can proceed with the application or schedule another call to address any remaining concerns. It's essential to take the time you need to make an informed decision.

Prospect: I'll think about it and let you know.

Agent: Absolutely. Take all the time you need. Feel free to reach out whenever you're ready, and I'll be here to assist you. Thank you for your time today, [Prospect's Name]. Have a wonderful day!

Takeaways

When crafting your script for selling final expense insurance, it's important to remember that every agent has their own unique style and approach. While it's essential to tailor the script to your personal preferences, there are a few key elements that should always be present.

First and foremost, empathy and understanding should be at the forefront of every conversation. End-of-life planning is an emotional and sensitive topic, and acknowledging this with compassion can go a long way in building trust with your clients.

By showing genuine care and concern, you create a safe space for individuals to share their concerns, and also build trust

In addition to empathy, it's crucial to prioritize your clients' best interests. As an agent, your role is to provide them with all the necessary information and guidance to make well-informed decisions about final expense insurance.

This means taking the time to understand their unique financial situation, end-of-life wishes, and any concerns they may have. By tailoring the policy to meet their specific needs and budget, you can ensure that they are getting the most suitable coverage.

Equipping your clients with the necessary information is also a key aspect of your role. Explaining the features and benefits of final expense insurance in a clear and concise manner can help them understand the value it provides.

This includes discussing the ease of qualification, the coverage options available, and any additional features such as guaranteed cash value or level premiums. By presenting these details in an easy-to-understand way, you reduce friction, and empower your clients to make educated decisions about their final expense insurance.

Ultimately, the goal of your script should be to build trust, provide valuable information, and assist your clients in making the best choice for their needs. By maintaining empathy and understanding, prioritizing their best interests, and equipping them with the necessary information, you can ensure that your conversations are productive and beneficial for both parties involved.

Download PDF of the guide and incorporate the proven script into your business today!

|

By leveraging up-to-date industry insights, marketing strategies, and detailed market analyses, you can enhance your service offerings and tailor your approach to meet the specific needs of various customer segments. Additionally, our guides offer practical tips on networking and building stronger relationships, ensuring that you not only reach potential clients more effectively but also create lasting connections that foster loyalty and word-of-mouth referrals.

By leveraging up-to-date industry insights, marketing strategies, and detailed market analyses, you can enhance your service offerings and tailor your approach to meet the specific needs of various customer segments. Additionally, our guides offer practical tips on networking and building stronger relationships, ensuring that you not only reach potential clients more effectively but also create lasting connections that foster loyalty and word-of-mouth referrals.