|

Retirement Plus Multiplier® (RPM) Annuity Highlights:

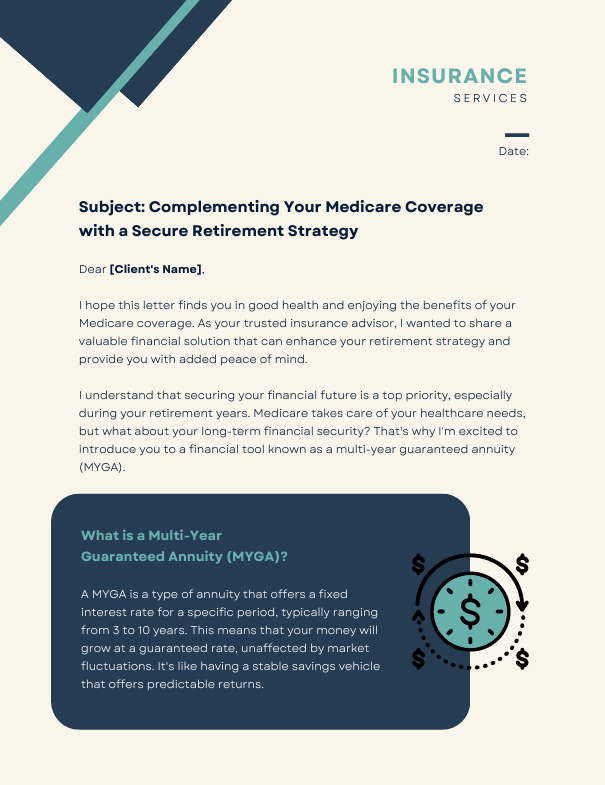

*All product recommendations must be prioritized in the consumer’s best interest. What Phase is Your Client In:

Whether your client is currently accumulating their wealth, preparing for retirement, or in retirement, RPM may be a helpful addition to their retirement strategy. Prepare Protect Enjoy

|

|||||

Medicare Blog | Medicare News | Medicare Information

Help Clients Prepare, Protect, and Enjoy Retirement with RPM

Posted by www.psmbrokerage.com Admin on Mon, Apr 22, 2024 @ 11:32 AM

Join PSM Brokerage and Elevate Your Career as an Independent Agent!

Posted by www.psmbrokerage.com Admin on Wed, Apr 17, 2024 @ 10:09 AM

|

Join PSM Brokerage now to offer a robust portfolio of Medicare Plans, Life Insurance and Annuities and leverage the expanding market demand. If your sales skills are top-notch and you have a focused, goal-driven mindset, you're precisely the partner we're seeking. We provide robust leadership, advanced sales tools, effective sales strategies, dedicated training, outstanding mentorship, and beyond.

As a reputable FMO, we provide:

Joining forces with PSM Brokerage means becoming a vital part of a collaborative and thriving community of agents. This unique community is deeply committed to mutual support, sharing knowledge, and fostering an environment where everyone can excel.

Our Mission:We nurture, educate, and assist our agents in every way possible. We are relentless in our dedication to bring value and go above and beyond expectations. We provide best-in-class service and do it with a smile. We conduct ourselves with integrity and honesty. We develop a culture of success with team members and agents to inspire them to reach their full potential. We will create an environment that serves our goals using honesty, humor, and humility. We are the home for high-producing agents and high-value agencies. The fruits of our hard work are visible daily as we continue to grow and attract higher production and lasting relationships. If you're an agent interested in taking your career to the next level and eager to thrive, we want to hear from you. PSM Brokerage is committed to empowering agents with the tools, training, and community support needed to succeed. We offer a collaborative environment where your growth is our priority, backed by a suite of resources designed to maximize your potential.

PSM Brokerage was founded in 2006, in Austin, Texas. In the intervening time with almost two decades of experience, PSM has grown to a nationwide footprint, with a mission to empower agents to honestly and ethically help people live longer, healthier and more financially secure lives.

|

||||

Tags: Annuities, Medicare Advantage, Medicare Supplement, New Business Opportunities, Life Insurance

2024: Unprecedented Opportunity in Insurance as Record Boomers Hit Retirement

Posted by www.psmbrokerage.com Admin on Wed, Jan 24, 2024 @ 11:05 AM

|

In 2024, the insurance industry is poised to experience a significant surge in demand, thanks to a record number of Baby Boomers reaching retirement age. This demographic milestone opens up a vast opportunity for insurance sales, particularly in areas directly relevant to retirees. Products like Medicare Advantage, Medicare supplements, long-term care insurance, and life insurance policies that offer financial security and peace of mind to seniors are likely to see increased interest. As this age group transitions into retirement, their focus shifts towards managing health expenses, securing lifelong income, and ensuring a legacy for their loved ones, making them ideal candidates for these types of insurance products. Moreover, this shift isn't just about numbers; it's about changing needs and priorities. Financial planning services, annuities, and final expense insurance are also areas ripe for growth, as more Boomers seek to safeguard their retirement savings and plan for the future. Insurance agents and companies who can effectively communicate the value and relevance of their products to this demographic stand to benefit significantly. The opportunity is here! The role of an independent insurance agent catering to the senior demographic offers more than just a career; it presents a pathway to a fulfilling, flexible, and financially rewarding profession. In the face of the growing senior market, the ability to generate residual income, and the autonomy of being your own boss, this career path stands out as an excellent choice for those looking to make a positive impact while building a sustainable business. As the population ages, the need for knowledgeable, compassionate, and dedicated Medicare plan agents will only grow, making now an ideal time to step into this rewarding field. Work with a trusted partner

|

||||

Tags: Final Expense, Annuities, Hospital Indemnity, Medicare Advantage, Medicare Supplement

Boost Your Sales in 2024: Discover Innovative Strategies for Selling Annuities

Posted by www.psmbrokerage.com Admin on Thu, Jan 18, 2024 @ 10:15 AM

|

As we step into 2024, the landscape of annuity sales is evolving rapidly. Insurance agents are finding themselves at the crossroads of traditional methods and innovative strategies. In this competitive market, it's crucial to stay ahead of the curve. Whether you're a seasoned professional or new to the industry, this blog is your go-to guide for unlocking the potential of annuity sales in the coming year. The Annuity Market of 2024:

Personalize Your Approach Each client's financial situation is unique. Personalization in your sales approach is key. Invest time in understanding your clients' specific needs, fears, and retirement goals. Tailoring your recommendations to match their individual circumstances can significantly increase trust and the likelihood of a sale. Focus on Education, Not Just Sales Today's clients are more informed and expect transparency. Instead of a hard sell, focus on educating them about how annuities can fit into their overall financial plan. Use simple language to explain complex products and be transparent about fees and potential risks. Build Strong Relationships Long-term relationships are more valuable than one-time sales. Keep in touch with clients through regular updates, newsletters, or personal check-ins. A satisfied client is a potential referral source. Prioritize customer satisfaction and service.

Leverage Client Testimonials and Success Stories Client testimonials and success stories are powerful tools. They provide social proof and help potential clients relate to the benefits of annuities. Always seek permission before sharing any client's story, ensuring confidentiality and compliance with regulations. Networking and Partnerships Build a network with professionals like estate planners, accountants, and attorneys. These partnerships can lead to referrals and provide a holistic service to your clients. Join industry associations and attend conferences to stay connected and informed. Selling annuities successfully in 2024 requires a blend of traditional sales acumen and innovative strategies. By embracing technology, personalizing your approach, focusing on education, building strong relationships, diversifying your product knowledge, leveraging testimonials, and establishing a strong network, you can significantly enhance your annuity sales. Remember, in the world of annuity sales, it's not just about the product; it's about providing solutions and security for your clients' future.

We have drafted up an effective cross-marketing letter you can use to market annuities to your Medicare clients. If you would like it personalized, please reach out to us today.

|

|||||

Tags: Annuities, cross marketing

F&G: How can you jump start your clients' retirement?

Posted by www.psmbrokerage.com Admin on Tue, Dec 19, 2023 @ 09:32 AM

|

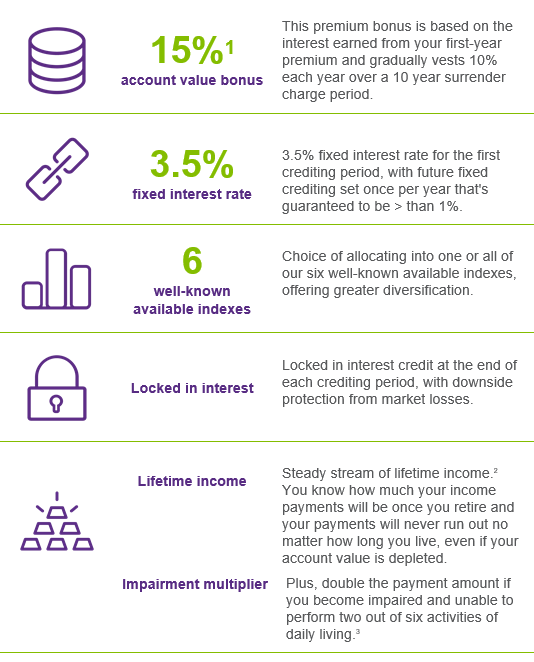

How can you jump start your clients' retirement? With a New Year rapidly approaching, learn how F&G’s Performance Pro®, a fixed indexed annuity, can reignite your clients’ retirement with a 15%1 jump start. In summary, Performance Pro offers:

Check out our latest flyer to learn how Performance Pro’s premium bonus can jump start your clients’ retirement goals today.

|

|||||

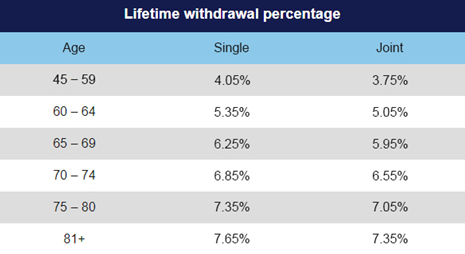

Higher lifetime withdrawal rates for Nationwide Peak® 10

Posted by www.psmbrokerage.com Admin on Mon, Dec 11, 2023 @ 04:23 PM

|

Provide your clients with even more guaranteed retirement income! Effective December 11, 2023, Nationwide is boosting withdrawal percentages on the Bonus Income+ rider for the Nationwide Peak 10® fixed indexed annuity.

|

||||||

Tags: Annuities, Nationwide

Looking for the industry's best MYGA rates?

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 01:33 PM

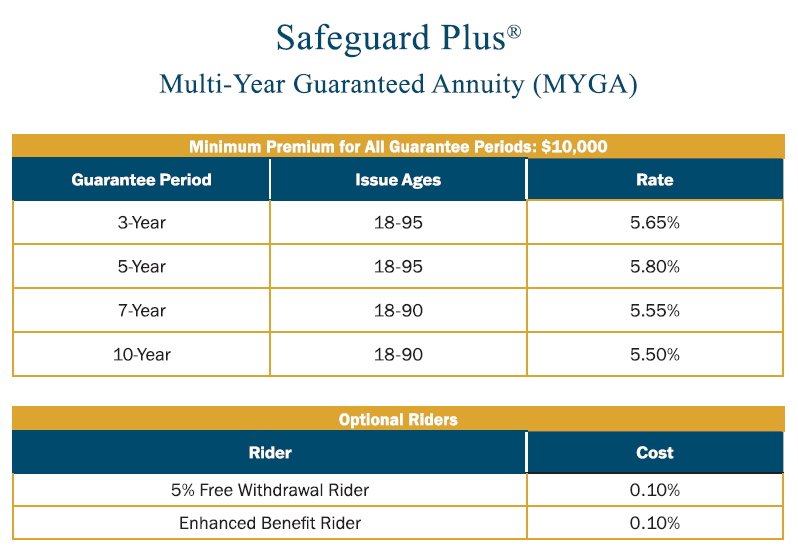

Product Spotlight: Safeguard Plus

Posted by www.psmbrokerage.com Admin on Thu, Nov 02, 2023 @ 01:29 PM

|

A Safeguard Plus® MYGA from Farmers Life Insurance Company is a single premium deferred fixed annuity that offers predictable interest earnings for a specified Regardless of their savings timeline, clients can also benefit from:

|

||||

What should you expect working with an Annuity FMO

Posted by www.psmbrokerage.com Admin on Mon, Oct 23, 2023 @ 02:25 PM

|

A Field Marketing Organization (FMO) specializing in annuities is a key player in the insurance and financial services industry, serving as an intermediary between insurance carriers or financial institutions and independent agents or financial advisors. An Annuity FMO offers critical support to agents and advisors focused on selling annuities, which are financial products designed to provide a stream of income for clients during retirement. Here are the primary functions and roles of an Annuity FMO: Product Expertise: Annuity FMOs provide agents and advisors with in-depth knowledge about various types of annuities, such as fixed annuities, variable annuities, and indexed annuities. This knowledge enables agents to assist clients in selecting the most suitable annuity products. Carrier Contracts: FMOs assist agents in contracting with multiple insurance carriers or financial institutions that offer annuities. This broadens the range of annuity products agents can offer to clients. Education and Training: Annuity FMOs offer ongoing education and training programs to ensure agents stay current with the latest annuity products, regulations, and sales techniques. Sales Support: They often provide marketing materials, sales tools, and guidance on effective strategies for selling annuities. Commission Management: Annuity FMOs assist agents in tracking and managing commissions, ensuring agents are fairly compensated for their sales efforts. Compliance Assistance: FMOs help agents navigate regulatory requirements and compliance issues related to annuity sales. Market Insights: They may provide agents with market insights, trends, and data to help them make informed decisions and adapt their sales strategies to changing market conditions. Client Support: Some FMOs offer post-sale support to clients, helping address their questions and concerns related to their annuity contracts. An Annuity FMO plays a crucial role in helping agents and advisors serve their clients by offering comprehensive product knowledge, compliance guidance, marketing support, and a broad range of annuity options. This support benefits both the agents and their clients by ensuring that annuity sales are conducted ethically and professionally, leading to well-informed investment decisions for those seeking retirement income solutions. Check out our Agent Programs and Services Guide to learn more about PSM and the services we proudly offer the agents we work with.

|

MYGA Cross-Marketing Letter for Medicare Clients

Posted by www.psmbrokerage.com Admin on Mon, Jul 31, 2023 @ 02:54 PM

Selling annuities can offer numerous advantages in today's insurance industry, allowing insurance professionals to fulfill their clients' financial security and peace of mind objectives. While you may already provide a range of insurance products, exploring the sale of annuities can be highly beneficial.

View Sample Prospecting Letter |

||

| Newest Blog Posts | All Blog Posts |

.png?width=400&height=400&name=Learn%20MORE%20(1).png)