|

Download our helpful guide to deepen your understanding of selling Dual Special Needs Plans to seniors. This essential resource is tailored to help agents like you navigate the complexities of these plans, highlighting key strategies for effectively reaching and serving the senior demographic. Whether you're new to this segment of Medicare or looking to refine your approach, our guide provides valuable insights and practical tips to enhance your sales techniques and improve client engagement. The Breakdown:

|

Medicare Blog | Medicare News | Medicare Information

Unlock New Opportunities with DSNP Plans

Posted by www.psmbrokerage.com Admin on Wed, Apr 17, 2024 @ 10:14 AM

Tags: Medicare Advantage, DSNP, Guide

Guide to Scaling Your Medicare Business

Posted by www.psmbrokerage.com Admin on Wed, Apr 17, 2024 @ 10:13 AM

Tags: Medicare Advantage, Medicare Supplement, Insurance Marketing, Digital Marketing, Agency Building

Join PSM Brokerage and Elevate Your Career as an Independent Agent!

Posted by www.psmbrokerage.com Admin on Wed, Apr 17, 2024 @ 10:09 AM

|

Join PSM Brokerage now to offer a robust portfolio of Medicare Plans, Life Insurance and Annuities and leverage the expanding market demand. If your sales skills are top-notch and you have a focused, goal-driven mindset, you're precisely the partner we're seeking. We provide robust leadership, advanced sales tools, effective sales strategies, dedicated training, outstanding mentorship, and beyond.

As a reputable FMO, we provide:

Joining forces with PSM Brokerage means becoming a vital part of a collaborative and thriving community of agents. This unique community is deeply committed to mutual support, sharing knowledge, and fostering an environment where everyone can excel.

Our Mission:We nurture, educate, and assist our agents in every way possible. We are relentless in our dedication to bring value and go above and beyond expectations. We provide best-in-class service and do it with a smile. We conduct ourselves with integrity and honesty. We develop a culture of success with team members and agents to inspire them to reach their full potential. We will create an environment that serves our goals using honesty, humor, and humility. We are the home for high-producing agents and high-value agencies. The fruits of our hard work are visible daily as we continue to grow and attract higher production and lasting relationships. If you're an agent interested in taking your career to the next level and eager to thrive, we want to hear from you. PSM Brokerage is committed to empowering agents with the tools, training, and community support needed to succeed. We offer a collaborative environment where your growth is our priority, backed by a suite of resources designed to maximize your potential.

PSM Brokerage was founded in 2006, in Austin, Texas. In the intervening time with almost two decades of experience, PSM has grown to a nationwide footprint, with a mission to empower agents to honestly and ethically help people live longer, healthier and more financially secure lives.

|

||||

Tags: Annuities, Medicare Advantage, Medicare Supplement, New Business Opportunities, Life Insurance

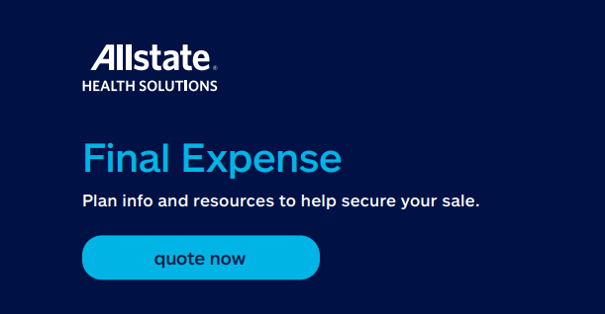

Allstate Final Expense Highlights

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:35 PM

|

Not appointed with Allstate? Request details here. Highlights

Plan Features

Quoting and enrolling - Log in to Agent Back Office at ngahagents.ngic.com to start your quoting process. If you are unable to quote online, call your sales team for assistance.

THIS PLAN PROVIDES LIMITED BENEFITS. For agent use only. Not to be distributed to consumers. Allstate Health Solutions markets products underwritten by National Health Insurance Company, Integon National Insurance Company, and Integon Indemnity Corporation. AHS_FE_1569 (02/2024) © 2024 Allstate Insurance Company. allstate.com or allstatehealth.com

|

|||||

Tags: Final Expense, Allstate

Empower Your Business with the PSM Brokerage Marketing Hub

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:04 PM

|

The PSM Marketing Hub is your gateway to a carefully crafted and compliant collection of premium, easy-to-use marketing templates designed by our marketing team with your needs in mind.

|

|||||

Tags: Insurance Marketing, Digital Marketing, PSM Marketing Hub

Royal Neighbors Single Premium Whole Life (SPWL)

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:04 PM

|

May be suitable for a client where:

Financial needs met by the product:

Target market:

#1 Riders not available in all states. See also the “Available Rider” section.

|

||||||||||||||||||

2025 Devoted Health Expansion Opportunities

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:03 PM

|

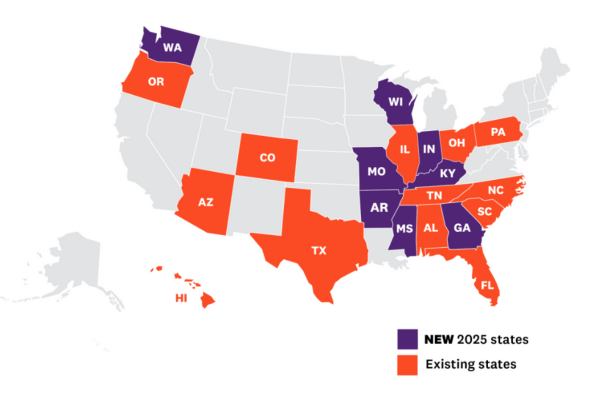

PSM is proud to spotlight Devoted Health Medicare Advantage Plans We are delighted to promote our partnership with Devoted Health, making their highly coveted Medicare Advantage plans available in newly expanded regions. This presents a prime opportunity for you to join a successful team and propel your career in the Medicare industry to new heights! Ask us for details on what sets Devoted apart from the competition — and why you won’t want to sell others' products. You won’t regret it! As Devoted Health broadens its reach to include Arkansas, Georgia, Indiana, Kentucky, Missouri, Mississippi, Washington, and Wisconsin, this is the perfect opportunity to expand your client base and enhance your earning possibilities like never before.

|

||||

Introducing Allstate Final Expense Plans

Posted by www.psmbrokerage.com Admin on Mon, Apr 15, 2024 @ 12:30 PM

|

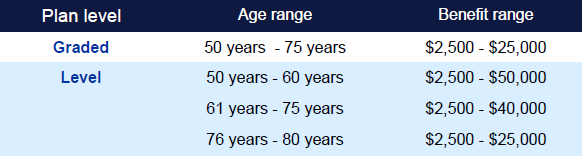

This new plan helps your customers take control of their end-of-life expenses. The total cash benefit is paid to their beneficiary, and they can use it any way they see fit. Final Expense offers two plan levels: Graded1 and Level. Plans offer customers the ability to choose their own benefit level in $1,000 increments.

Please note:

|

|||

Tags: Final Expense, Allstate

NABIP Professional Development Day recap

Posted by www.psmbrokerage.com Admin on Fri, Apr 12, 2024 @ 01:52 PM

|

PSM was a proud sponsor at this years NABIP Austin - Professional Development Day.

The event provided a valuable platform for licensed agents and NABIP members to advance their skills and knowledge through ongoing learning and collaboration, enhancing career growth and boosting industry competence and productivity. We are immensely proud to be part of this collective effort and look forward to continued participation in future events. Thank you to all who participated!

|

|||||

Tags: NABIP

CMS: Contract Year 2025 Medicare Advantage and Part D Final Rule (CMS-4205-F)

Posted by www.psmbrokerage.com Admin on Fri, Apr 12, 2024 @ 09:08 AM

|

Background On April 4, 2024, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that revises the Medicare Advantage Program, Medicare Prescription Drug Benefit Program (Medicare Part D), Medicare Cost Plan Program, Programs of All-Inclusive Care for the Elderly (PACE), and Health Information Technology Standards and Implementation Specifications. Additionally, this final rule addresses several key provisions that remain from the CY 2024 Medicare Advantage and Part D proposed rule, CMS-4201-P, published on December 14, 2022. Together, the changes in this final rule build on existing Biden-Harris Administration policies to strengthen protections and guardrails, promote healthy competition, and ensure Medicare Advantage and Part D plans best meet the needs of enrollees. In addition, these policies promote access to behavioral health care providers, promote equity in coverage, and improve supplemental benefits. This fact sheet discusses the major provisions of the 2025 final rule which can be downloaded here: https://www.federalregister.gov/public-inspection/2024-07105/medicare-program-medicare-advantage-and-the-medicare-prescription-drug-benefit-program-for-contract Many individuals with Medicare rely on agents and brokers to help navigate complex Medicare choices as they comparison shop for coverage options. The Medicare statute requires that CMS must establish guidelines to ensure that the use of compensation creates incentives for agents and brokers to enroll individuals in the Medicare Advantage or Part D plan intended to best meet the prospective enrollee’s health care needs. However, excessive compensation, and other bonus arrangements, offered by plans to agents and brokers can result in individuals being steered to some Medicare Advantage and Part D plans over others based on the agent or broker’s financial interests, rather than the prospective enrollee’s health care needs. CMS is cracking down on that. Specifically, CMS is finalizing requirements that redefine “compensation” to set a clear, fixed amount that agents and brokers can be paid regardless of the plan the individual enrolls in, addressing loopholes that result in commissions above this amount that create anti-competitive and anti-consumer steering incentives. The provisions of this final rule, which are applicable beginning with the upcoming Annual Enrollment Period, ensure that agent and broker compensation reflect only the legitimate activities required of agents and brokers, by broadening the scope of the regulatory definition of “compensation,” so that it is inclusive of all activities associated with the sales to/enrollment of an individual into a Medicare Advantage or Part D plan. In response to feedback from stakeholders, CMS is increasing the final national agent/broker fixed compensation amount for initial enrollments into a Medicare Advantage or Part D plan by $100, which is an amount higher than what was proposed ($31). CMS believes this increase will provide agents and brokers with sufficient funds to serve individuals with Medicare. This increase will eliminate variability in payments and improve the predictability of compensation for agents and brokers. This increase will be added to agent and broker compensation payments for the Annual Election Period in Fall 2024 and applied to all enrollments effective in CY2025 and future contract years. Additionally, the final rule generally prohibits contract terms between Medicare Advantage organizations/Part D sponsors and middleman Third Party Marketing Organizations (TPMOs), such as field marketing organizations, which may directly or indirectly create an incentive to inhibit an agent or broker’s ability to objectively assess and recommend the plan that is best suited to a potential enrollee’s needs. In the final rule, CMS provides several examples of contract terms that will be impermissible under this prohibition, including provisions offering volume-based bonuses for enrollment into certain plans. These final policies advance the goals of President Biden’s historic Competition Council and Executive Order signed in July 2021, by helping to ensure a robust and competitive Medicare Advantage marketplace.

|

||||

Tags: Medicare Advantage, CMS

What is a Dual Eligible Special Needs Plan?

What is a Dual Eligible Special Needs Plan?

PSM Brokerage recently sponsored and participated in the

PSM Brokerage recently sponsored and participated in the