|

Not appointed with Allstate? Request details here. Highlights

Plan Features

Quoting and enrolling - Log in to Agent Back Office at ngahagents.ngic.com to start your quoting process. If you are unable to quote online, call your sales team for assistance.

THIS PLAN PROVIDES LIMITED BENEFITS. For agent use only. Not to be distributed to consumers. Allstate Health Solutions markets products underwritten by National Health Insurance Company, Integon National Insurance Company, and Integon Indemnity Corporation. AHS_FE_1569 (02/2024) © 2024 Allstate Insurance Company. allstate.com or allstatehealth.com

|

|||||

Medicare Blog | Medicare News | Medicare Information

Allstate Final Expense Highlights

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:35 PM

Tags: Final Expense, Allstate

Empower Your Business with the PSM Brokerage Marketing Hub

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:04 PM

|

The PSM Marketing Hub is your gateway to a carefully crafted and compliant collection of premium, easy-to-use marketing templates designed by our marketing team with your needs in mind.

|

Tags: Insurance Marketing, Digital Marketing, PSM Marketing Hub

Royal Neighbors Single Premium Whole Life (SPWL)

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:04 PM

|

May be suitable for a client where:

Financial needs met by the product:

Target market:

#1 Riders not available in all states. See also the “Available Rider” section.

|

||||||||||||||||||

2025 Devoted Health Expansion Opportunities

Posted by www.psmbrokerage.com Admin on Tue, Apr 16, 2024 @ 03:03 PM

|

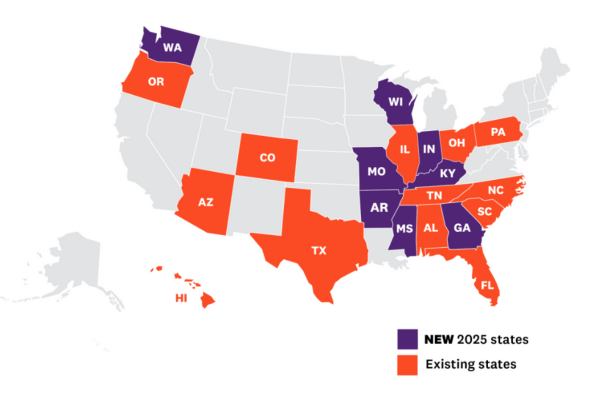

PSM is proud to spotlight Devoted Health Medicare Advantage Plans We are delighted to promote our partnership with Devoted Health, making their highly coveted Medicare Advantage plans available in newly expanded regions. This presents a prime opportunity for you to join a successful team and propel your career in the Medicare industry to new heights! Ask us for details on what sets Devoted apart from the competition — and why you won’t want to sell others' products. You won’t regret it! As Devoted Health broadens its reach to include Arkansas, Georgia, Indiana, Kentucky, Missouri, Mississippi, Washington, and Wisconsin, this is the perfect opportunity to expand your client base and enhance your earning possibilities like never before.

|

||||

Introducing Allstate Final Expense Plans

Posted by www.psmbrokerage.com Admin on Mon, Apr 15, 2024 @ 12:30 PM

|

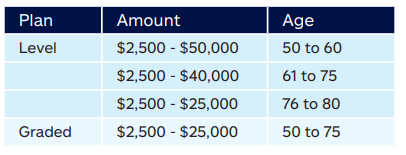

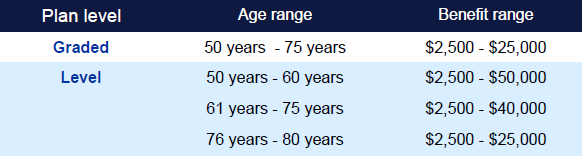

This new plan helps your customers take control of their end-of-life expenses. The total cash benefit is paid to their beneficiary, and they can use it any way they see fit. Final Expense offers two plan levels: Graded1 and Level. Plans offer customers the ability to choose their own benefit level in $1,000 increments.

Please note:

|

|||

Tags: Final Expense, Allstate

NABIP Professional Development Day recap

Posted by www.psmbrokerage.com Admin on Fri, Apr 12, 2024 @ 01:52 PM

|

PSM was a proud sponsor at this years NABIP Austin - Professional Development Day.

The event provided a valuable platform for licensed agents and NABIP members to advance their skills and knowledge through ongoing learning and collaboration, enhancing career growth and boosting industry competence and productivity. We are immensely proud to be part of this collective effort and look forward to continued participation in future events. Thank you to all who participated!

|

|||||

Tags: NABIP

CMS: Contract Year 2025 Medicare Advantage and Part D Final Rule (CMS-4205-F)

Posted by www.psmbrokerage.com Admin on Fri, Apr 12, 2024 @ 09:08 AM

|

Background On April 4, 2024, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that revises the Medicare Advantage Program, Medicare Prescription Drug Benefit Program (Medicare Part D), Medicare Cost Plan Program, Programs of All-Inclusive Care for the Elderly (PACE), and Health Information Technology Standards and Implementation Specifications. Additionally, this final rule addresses several key provisions that remain from the CY 2024 Medicare Advantage and Part D proposed rule, CMS-4201-P, published on December 14, 2022. Together, the changes in this final rule build on existing Biden-Harris Administration policies to strengthen protections and guardrails, promote healthy competition, and ensure Medicare Advantage and Part D plans best meet the needs of enrollees. In addition, these policies promote access to behavioral health care providers, promote equity in coverage, and improve supplemental benefits. This fact sheet discusses the major provisions of the 2025 final rule which can be downloaded here: https://www.federalregister.gov/public-inspection/2024-07105/medicare-program-medicare-advantage-and-the-medicare-prescription-drug-benefit-program-for-contract Many individuals with Medicare rely on agents and brokers to help navigate complex Medicare choices as they comparison shop for coverage options. The Medicare statute requires that CMS must establish guidelines to ensure that the use of compensation creates incentives for agents and brokers to enroll individuals in the Medicare Advantage or Part D plan intended to best meet the prospective enrollee’s health care needs. However, excessive compensation, and other bonus arrangements, offered by plans to agents and brokers can result in individuals being steered to some Medicare Advantage and Part D plans over others based on the agent or broker’s financial interests, rather than the prospective enrollee’s health care needs. CMS is cracking down on that. Specifically, CMS is finalizing requirements that redefine “compensation” to set a clear, fixed amount that agents and brokers can be paid regardless of the plan the individual enrolls in, addressing loopholes that result in commissions above this amount that create anti-competitive and anti-consumer steering incentives. The provisions of this final rule, which are applicable beginning with the upcoming Annual Enrollment Period, ensure that agent and broker compensation reflect only the legitimate activities required of agents and brokers, by broadening the scope of the regulatory definition of “compensation,” so that it is inclusive of all activities associated with the sales to/enrollment of an individual into a Medicare Advantage or Part D plan. In response to feedback from stakeholders, CMS is increasing the final national agent/broker fixed compensation amount for initial enrollments into a Medicare Advantage or Part D plan by $100, which is an amount higher than what was proposed ($31). CMS believes this increase will provide agents and brokers with sufficient funds to serve individuals with Medicare. This increase will eliminate variability in payments and improve the predictability of compensation for agents and brokers. This increase will be added to agent and broker compensation payments for the Annual Election Period in Fall 2024 and applied to all enrollments effective in CY2025 and future contract years. Additionally, the final rule generally prohibits contract terms between Medicare Advantage organizations/Part D sponsors and middleman Third Party Marketing Organizations (TPMOs), such as field marketing organizations, which may directly or indirectly create an incentive to inhibit an agent or broker’s ability to objectively assess and recommend the plan that is best suited to a potential enrollee’s needs. In the final rule, CMS provides several examples of contract terms that will be impermissible under this prohibition, including provisions offering volume-based bonuses for enrollment into certain plans. These final policies advance the goals of President Biden’s historic Competition Council and Executive Order signed in July 2021, by helping to ensure a robust and competitive Medicare Advantage marketplace.

|

||||

Tags: Medicare Advantage, CMS

Hospital Indemnity Benefit Needs Estimator

Posted by www.psmbrokerage.com Admin on Thu, Apr 11, 2024 @ 10:10 AM

Offering hospital indemnity plans allows insurance professionals to meet the evolving needs of healthcare consumers, provide valuable supplemental coverage, and offer added financial protection in times of medical uncertainty.By providing fixed benefits for hospital stays and medical services, hospital indemnity plans offer a layer of financial protection that helps individuals manage unexpected healthcare costs more effectively. Download this helpful resource today.

|

||||

SunFire Medicare Supplement & DVH Launch Details

Posted by www.psmbrokerage.com Admin on Tue, Apr 09, 2024 @ 01:28 PM

|

Medicare Supplement and Dental, Vision & Hearing (DVH) will be available starting April 10th. The new platform gives you more flexibility to offer additional benefits and improve efficiency. We’ve built a strong foundation with key features and will continue to add carrier integrations and other enhancements. Medicare Supplement 54 Carriers will be available for Medicare Supplement Quoting, 5 Carriers will be available for full integrated enrollment. Features include:

Full enrollment form integration with Aetna, Cigna, Anthem, Fallon and IBX will be available to start, with MOO, Humana, and Aflac planned to release before AEP. Thirteen additional carrier enrollments are available via external links, with many more on the way!

Get alerts when an applicant is unlikely to pass underwriting using our Medicare Supplement needs assessment which captures drug and medical condition data.

Quickly move from Medicare Supplement to MA/MAPD quoting and enrollment if underwriting logic suggests that Medicare Supplement may not be the best path. All client data is preserved between products.

Post-enrollment bundling experience creates significant efficiencies by passing captured drug and demographic data into DVH and PDP applications (displayed post sale).

|

|||||

Tags: dental hearing and vision insurance, Medicare Advantage, Medicare Supplement, SunFireMatrix

3 Tips for Success in Insurance

Posted by www.psmbrokerage.com Admin on Wed, Apr 03, 2024 @ 10:08 AM

|

Foster Relationships: Success in the insurance business often hinges on the strength and depth of your relationships. This includes not only your relationships with customers or clients but also with mentors, partners, carriers, and even competitors. Building a strong network based on trust, mutual respect, and value exchange can open doors to new opportunities, provide support in challenging times, and offer insights from different perspectives. Regular communication, active listening, and a genuine interest in others' success are key strategies for nurturing these relationships. Adaptability and Continuous Learning: The insurance business landscape is ever-changing, influenced by technological advancements, market trends, and consumer behaviors. Staying successful requires a willingness to adapt and evolve. This means being open to new ideas, embracing innovation, and being ready to pivot your strategy when necessary. Continuous learning, through formal education, self-study, or experiential learning, is vital. It keeps you informed about industry trends, helps you stay ahead of the competition, and fosters a culture of innovation within your organization. Strategic Planning and Execution: Having a clear, actionable business plan with specific, measurable goals is fundamental to success. A well-thought-out strategy helps guide your decisions and outlines the steps needed to achieve your objectives. However, a plan is only as good as its execution. Effective execution requires focus, discipline, and the ability to manage resources efficiently. Regularly review your progress towards your goals, be prepared to make adjustments as needed, and always keep the big picture in mind. Remember, success is not just about the ideas you have but about how well you can bring them to life.

|

|||||||

Tags: Success Tips

PSM Brokerage recently sponsored and participated in the

PSM Brokerage recently sponsored and participated in the